Emergence of 5G Technology

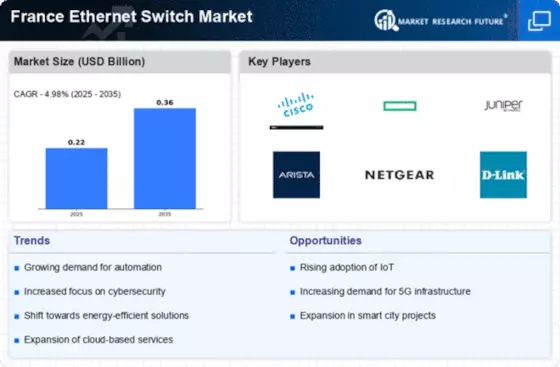

The rollout of 5G technology in France is anticipated to be a significant catalyst for the France Ethernet Switch Market. 5G networks promise higher speeds, lower latency, and greater capacity, which necessitates the deployment of advanced Ethernet switches to manage the increased data flow. As telecommunications companies expand their 5G infrastructure, there will be a corresponding demand for Ethernet switches that can support the high-performance requirements of 5G applications. This technological advancement is likely to create new opportunities for Ethernet switch manufacturers and service providers, thereby driving market growth in the coming years.

Growing Adoption of Cloud Services

The increasing adoption of cloud services in France is a pivotal driver for the France Ethernet Switch Market. As businesses migrate to cloud-based solutions, the demand for robust networking infrastructure intensifies. Ethernet switches play a crucial role in facilitating seamless connectivity and data transfer between on-premises systems and cloud environments. According to recent data, the cloud computing market in France is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2026. This growth necessitates advanced Ethernet switches that can handle higher bandwidths and support virtualization, thereby propelling the Ethernet switch market forward.

Focus on Cybersecurity Enhancements

The growing emphasis on cybersecurity in France is shaping the France Ethernet Switch Market. As cyber threats become more sophisticated, organizations are prioritizing the implementation of secure networking solutions. Ethernet switches equipped with advanced security features, such as network segmentation and threat detection, are increasingly sought after. The French government has introduced various regulations aimed at enhancing cybersecurity across industries, which is likely to drive the demand for secure Ethernet switches. This focus on cybersecurity not only protects sensitive data but also fosters trust among consumers, further contributing to the growth of the Ethernet switch market.

Rising Internet of Things (IoT) Deployments

The proliferation of Internet of Things (IoT) devices in France is significantly influencing the France Ethernet Switch Market. With the increasing number of connected devices, there is a pressing need for efficient data management and communication. Ethernet switches are essential for managing the data traffic generated by IoT devices, ensuring reliable connectivity and low latency. The French government has been actively promoting IoT initiatives, which is expected to drive the deployment of Ethernet switches in various sectors, including smart homes, healthcare, and industrial automation. This trend indicates a robust growth trajectory for the Ethernet switch market as organizations seek to optimize their network infrastructure.

Investment in Network Infrastructure Upgrades

Ongoing investments in network infrastructure upgrades across various sectors in France are propelling the France Ethernet Switch Market. Organizations are increasingly recognizing the need to modernize their networking capabilities to support advanced applications and services. The French government has allocated substantial funding for digital infrastructure projects, which includes enhancing connectivity in urban and rural areas. This investment is likely to stimulate demand for high-performance Ethernet switches that can accommodate increased data traffic and provide enhanced security features. As a result, the Ethernet switch market is poised for growth as businesses seek to future-proof their networks.