Growing Health Consciousness

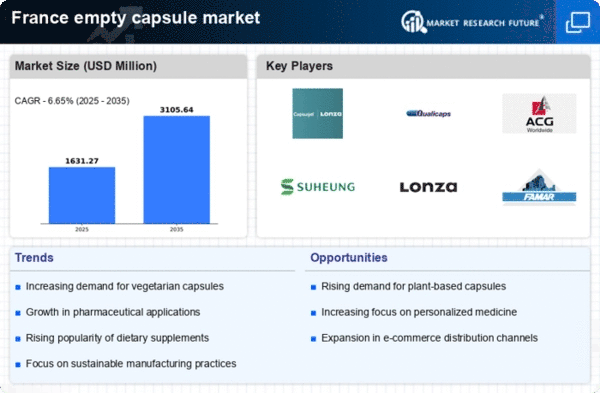

The increasing health consciousness among consumers in France appears to be a pivotal driver for the empty capsule market. As individuals become more aware of the benefits of dietary supplements and herbal products, the demand for empty capsules is likely to rise. This trend is reflected in the growing sales of nutraceuticals, which have seen an annual growth rate of approximately 8% in recent years. The empty capsule market is poised to benefit from this shift, as manufacturers strive to meet the rising demand for natural and organic products. Furthermore, the preference for vegetarian and vegan capsules is gaining traction, indicating a potential shift in consumer preferences that could further stimulate market growth.

Expansion of the Pharmaceutical Sector

The expansion of the pharmaceutical sector in France is another significant driver for the empty capsule market. With the country being home to numerous pharmaceutical companies, the demand for empty capsules is expected to increase as these companies develop new formulations and drug delivery systems. The pharmaceutical industry in France has been valued at over €50 billion, and the empty capsule market is likely to capture a portion of this growth. Additionally, the trend towards personalized medicine may lead to an increased need for customized capsule solutions, further enhancing the market's potential. This expansion is indicative of a broader trend towards innovation and development within the pharmaceutical landscape.

Regulatory Developments and Compliance

Regulatory developments and compliance requirements are critical drivers for the empty capsule market. In France, stringent regulations governing the production and sale of dietary supplements necessitate adherence to quality standards, which in turn influences the empty capsule market. Companies must ensure that their products meet safety and efficacy guidelines, which can drive innovation and improve product quality. The increasing focus on transparency and traceability in the supply chain may also lead to heightened demand for high-quality empty capsules. As regulatory frameworks evolve, manufacturers may need to adapt their practices, potentially creating opportunities for growth within the market.

Rising Popularity of Dietary Supplements

The rising popularity of dietary supplements in France is a notable driver for the empty capsule market. As consumers increasingly seek to enhance their health and wellness through supplements, the demand for empty capsules is likely to grow. The dietary supplement market in France has been projected to reach €3 billion by 2026, indicating a robust growth trajectory. This trend is further supported by the increasing acceptance of supplements among various demographics, including younger consumers. The empty capsule market stands to benefit from this surge, as manufacturers adapt to the evolving preferences of health-conscious consumers. The focus on convenience and ease of consumption is also likely to drive the demand for empty capsules.

Technological Innovations in Capsule Manufacturing

Technological innovations in capsule manufacturing are poised to significantly impact the empty capsule market. Advances in production techniques, such as the development of non-gelatin capsules and improvements in encapsulation technology, are likely to enhance product offerings. The empty capsule market is expected to see increased efficiency and reduced production costs as a result of these innovations. Furthermore, the introduction of new materials and formulations may cater to the growing demand for vegetarian and vegan options, aligning with consumer preferences. This technological evolution could potentially reshape the competitive landscape, allowing manufacturers to differentiate their products in a crowded market.