Influence of Celebrity Fragrances

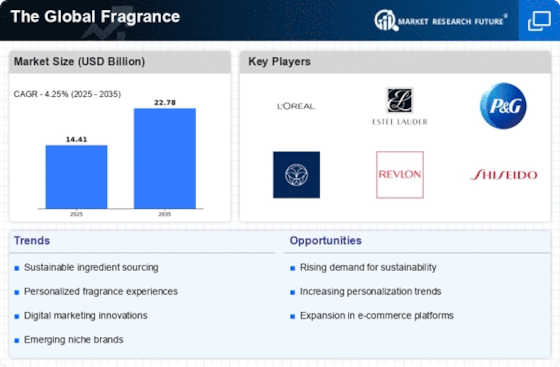

The proliferation of celebrity fragrances continues to shape The Global Fragrance Industry. High-profile endorsements and collaborations with celebrities often lead to increased brand visibility and consumer interest. Data indicates that celebrity fragrances can generate substantial sales, with some lines achieving revenues exceeding $100 million within their first year. This phenomenon suggests that consumers are drawn to the aspirational lifestyle associated with celebrity endorsements. However, the market may also face challenges as the saturation of celebrity fragrances could lead to consumer fatigue. Despite this, the allure of celebrity branding remains a potent driver in The Global Fragrance Industry, influencing purchasing decisions and brand loyalty.

Niche and Artisanal Fragrance Brands

The emergence of niche and artisanal fragrance brands is significantly impacting The Global Fragrance Industry. These brands often emphasize unique scent profiles and high-quality ingredients, appealing to consumers seeking personalized and exclusive experiences. Market data suggests that the niche fragrance segment has been growing at a rate of approximately 12% annually, indicating a shift in consumer preferences towards more distinctive offerings. This trend may be attributed to a desire for individuality and self-expression through fragrance. As consumers increasingly gravitate towards these specialized products, established brands may need to innovate and diversify their portfolios to capture this growing segment of the market. The rise of niche brands is likely to redefine competitive dynamics within The Global Fragrance Industry.

Rise of E-commerce in Fragrance Sales

The rapid expansion of e-commerce platforms is reshaping the retail landscape for The Global Fragrance Industry. Online sales channels have become increasingly popular, with data indicating that e-commerce sales in the fragrance sector could account for over 30% of total sales by 2026. This trend is driven by the convenience of online shopping, coupled with the ability to access a wider range of products. Additionally, social media marketing and influencer collaborations are enhancing brand visibility and consumer engagement. As a result, traditional brick-and-mortar stores may need to adapt their strategies to remain competitive in this evolving market. The rise of e-commerce is likely to continue influencing consumer purchasing behavior in The Global Fragrance Industry.

Sustainability in Fragrance Production

The increasing consumer awareness regarding environmental issues appears to drive The Global Fragrance Industry towards sustainable practices. Brands are now focusing on eco-friendly sourcing of raw materials, which not only appeals to environmentally conscious consumers but also aligns with regulatory trends favoring sustainability. The market for natural fragrances is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This shift towards sustainability may lead to innovations in production processes, reducing waste and carbon footprints. As consumers increasingly seek transparency in product sourcing, companies that prioritize sustainability are likely to gain a competitive edge in The Global Fragrance Industry.

Technological Advancements in Fragrance Development

Technological advancements are playing a crucial role in the evolution of The Global Fragrance Industry. Innovations in scent formulation and delivery systems are enabling brands to create more complex and appealing fragrances. For instance, advancements in artificial intelligence and machine learning are being utilized to analyze consumer preferences and predict trends, potentially leading to more successful product launches. Additionally, the use of sustainable technologies in production processes is becoming increasingly prevalent, aligning with consumer demand for eco-friendly products. As technology continues to advance, it is likely to enhance the creativity and efficiency of fragrance development, thereby influencing market dynamics in The Global Fragrance Industry.