Economic Incentives and Cost Savings

The Food Waste Composting Machine Market is also benefiting from economic incentives and cost savings associated with composting practices. Many businesses and municipalities are discovering that investing in composting machines can lead to significant reductions in waste disposal costs. By diverting organic waste from landfills, entities can lower their tipping fees and reduce overall waste management expenses. Additionally, compost produced from food waste can be utilized in landscaping and agriculture, providing a cost-effective alternative to chemical fertilizers. Recent analyses suggest that organizations implementing composting solutions can achieve a return on investment within a few years, making it an attractive option. This economic rationale is likely to drive further adoption within the Food Waste Composting Machine Market, as stakeholders seek to balance environmental responsibility with financial viability.

Innovations in Waste Management Practices

Innovations in waste management practices are reshaping the Food Waste Composting Machine Market. As cities and communities seek more effective ways to manage organic waste, new composting technologies and methodologies are emerging. For example, community composting initiatives and decentralized composting systems are gaining traction, allowing for localized processing of food waste. This approach not only reduces transportation costs but also fosters community engagement and education around waste reduction. Furthermore, advancements in machine design, such as compact and mobile composters, are making it easier for households and small businesses to participate in composting efforts. These innovations indicate a shift towards more sustainable waste management practices, which are likely to enhance the growth trajectory of the Food Waste Composting Machine Market.

Regulatory Support and Environmental Policies

The Food Waste Composting Machine Market is significantly influenced by regulatory support and environmental policies aimed at reducing waste and promoting sustainability. Governments are increasingly implementing regulations that encourage composting as a viable waste management solution. For instance, many regions have established mandates for organic waste diversion from landfills, which directly boosts the demand for composting machines. Recent statistics suggest that regions with stringent waste management policies have seen a marked increase in composting machine sales, as businesses and municipalities seek compliance. This regulatory landscape not only fosters growth in the Food Waste Composting Machine Market but also aligns with broader environmental goals, such as reducing greenhouse gas emissions and promoting circular economy practices.

Technological Advancements in Composting Solutions

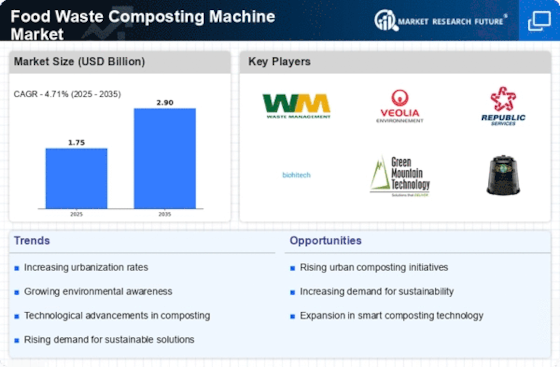

The Food Waste Composting Machine Market is experiencing a surge in technological advancements that enhance efficiency and effectiveness. Innovations such as aerobic digestion and anaerobic digestion technologies are being integrated into composting machines, allowing for faster decomposition of organic waste. These advancements not only reduce the time required for composting but also improve the quality of the end product. According to recent data, the adoption of smart composting systems, which utilize IoT technology for monitoring and management, is on the rise. This trend indicates a shift towards more automated and user-friendly solutions, appealing to both commercial and residential users. As technology continues to evolve, the Food Waste Composting Machine Market is likely to see increased investment and interest from various sectors, including agriculture, food service, and municipal waste management.

Rising Consumer Awareness and Demand for Sustainability

Consumer awareness regarding sustainability and environmental impact is driving growth in the Food Waste Composting Machine Market. As individuals and businesses become more conscious of their ecological footprint, there is a growing demand for solutions that facilitate waste reduction and resource recovery. Surveys indicate that a significant percentage of consumers are willing to invest in composting machines as part of their commitment to sustainable living. This trend is particularly evident in urban areas, where space-efficient composting solutions are sought after. The increasing popularity of organic gardening and local food movements further fuels this demand, as consumers recognize the benefits of composting for soil health and food production. Consequently, the Food Waste Composting Machine Market is poised for expansion, catering to a more environmentally aware consumer base.