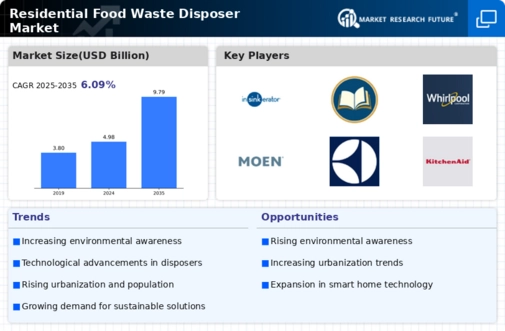

Increased Environmental Awareness

The rising consciousness regarding environmental issues appears to be a pivotal driver for the Residential food waste disposer Market. Consumers are increasingly aware of the detrimental effects of food waste on landfills and greenhouse gas emissions. This awareness has led to a growing demand for solutions that mitigate waste, such as food waste disposers. According to recent data, approximately 30 to 40% of the food supply is wasted, which underscores the urgency for effective waste management solutions. As households seek to adopt more sustainable practices, the Residential Food Waste Disposer Market is likely to experience significant growth, driven by the desire to reduce waste and promote eco-friendly living.

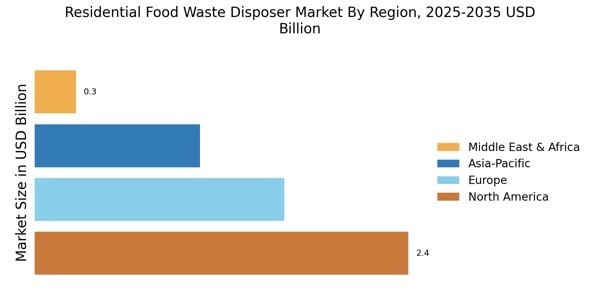

Urbanization and Population Growth

Urbanization and population growth are critical factors influencing the Residential Food Waste Disposer Market. As more individuals migrate to urban areas, the demand for efficient waste management solutions escalates. Urban households often face space constraints, making traditional waste disposal methods less feasible. The increasing population density in cities necessitates innovative solutions to manage food waste effectively. Data indicates that urban areas are expected to house over 68% of the world's population by 2050, which could lead to a surge in demand for food waste disposers. This trend suggests that the Residential Food Waste Disposer Market may expand significantly as urban dwellers seek convenient and efficient waste disposal options.

Government Regulations and Incentives

Government regulations and incentives aimed at reducing food waste are likely to play a substantial role in shaping the Residential Food Waste Disposer Market. Many governments are implementing policies that encourage sustainable waste management practices, including the use of food waste disposers. These regulations may include tax incentives for households that adopt eco-friendly technologies or mandates for waste reduction. As municipalities strive to meet sustainability goals, the Residential Food Waste Disposer Market could benefit from increased adoption rates. The potential for financial incentives may further motivate consumers to invest in food waste disposers, thereby driving market growth.

Technological Advancements in Waste Disposal

Technological advancements in waste disposal systems are emerging as a significant driver for the Residential Food Waste Disposer Market. Innovations such as noise reduction technology, energy-efficient models, and smart features that allow users to monitor waste disposal remotely are becoming increasingly popular. These advancements not only enhance user experience but also promote more efficient waste management practices. The integration of smart technology into food waste disposers is particularly appealing to tech-savvy consumers, suggesting that the market may see a shift towards more sophisticated models. As these technologies continue to evolve, the Residential Food Waste Disposer Market is likely to expand, catering to the demands of modern households.

Rising Disposable Income and Consumer Spending

Rising disposable income and consumer spending are expected to significantly impact the Residential Food Waste Disposer Market. As individuals experience an increase in their financial capacity, they are more inclined to invest in home appliances that enhance convenience and sustainability. The trend towards higher disposable income is particularly pronounced in emerging markets, where a growing middle class is seeking modern solutions for household management. This shift in consumer behavior indicates that the Residential Food Waste Disposer Market may witness increased sales as more households prioritize the purchase of food waste disposers. The correlation between economic growth and consumer spending suggests a promising outlook for the market.