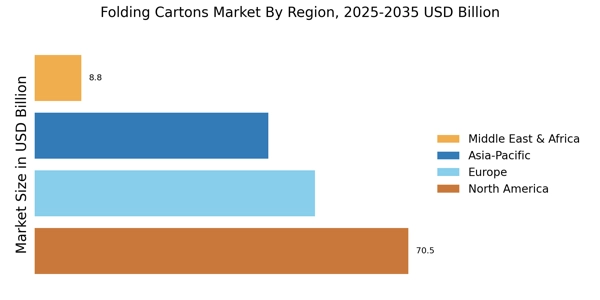

North America : Market Leader in Innovation

North America is the largest market for folding cartons, holding approximately 40% of the global market share. The region's growth is driven by increasing demand for sustainable packaging solutions, stringent regulations on plastic use, and a shift towards eco-friendly materials. The rise in e-commerce and retail sectors further fuels this demand, as brands seek attractive and functional packaging to enhance consumer experience. The United States and Canada are the leading countries in this market, with major players like WestRock, Graphic Packaging Holding Company, and International Paper dominating the landscape. The competitive environment is characterized by innovation in design and materials, with companies investing heavily in R&D to meet consumer preferences for sustainability and convenience. The presence of established firms ensures a robust supply chain and distribution network, enhancing market accessibility.

Europe : Sustainability and Regulation Focus

Europe is the second-largest market for folding cartons, accounting for approximately 30% of the global market share. The region's growth is propelled by stringent environmental regulations and a strong consumer preference for sustainable packaging. Initiatives like the European Green Deal aim to reduce plastic waste, driving demand for recyclable and biodegradable materials in packaging solutions. This regulatory landscape fosters innovation and investment in eco-friendly technologies. Leading countries in this market include Germany, France, and the United Kingdom, where companies like Smurfit Kappa and Mondi Group are key players. The competitive landscape is marked by a focus on sustainability, with firms adopting circular economy principles. The presence of numerous small and medium enterprises also contributes to a dynamic market, fostering innovation and responsiveness to consumer trends. The European market is characterized by collaboration between manufacturers and retailers to enhance packaging efficiency and sustainability.

Asia-Pacific : Emerging Market with High Growth

Asia-Pacific is witnessing rapid growth in the folding cartons market, holding approximately 25% of the global market share. The region's expansion is driven by increasing urbanization, rising disposable incomes, and a booming e-commerce sector. Countries like China and India are experiencing significant demand for packaging solutions, as consumer preferences shift towards convenience and sustainability. Government initiatives promoting manufacturing and exports further bolster market growth. China is the largest market in the region, followed by India and Japan. The competitive landscape features both local and international players, with companies like Amcor and DS Smith establishing a strong presence. The market is characterized by innovation in design and materials, with a focus on meeting the diverse needs of various industries, including food and beverage, pharmaceuticals, and consumer goods. The growing emphasis on sustainable practices is also shaping the competitive dynamics in this region.

Middle East and Africa : Untapped Potential in Packaging

The Middle East and Africa region is gradually emerging in the folding cartons market, holding about 5% of the global market share. The growth is driven by increasing consumer demand for packaged goods, urbanization, and a growing retail sector. Countries like South Africa and the UAE are leading the way, with investments in infrastructure and manufacturing capabilities enhancing market potential. The region's diverse demographics also present unique opportunities for tailored packaging solutions. South Africa is the largest market in the region, with a competitive landscape that includes both local and international players. Companies like Sappi are making strides in innovation and sustainability, focusing on meeting the needs of various sectors, including food and beverage and personal care. The market is characterized by a growing emphasis on eco-friendly packaging solutions, driven by consumer awareness and regulatory pressures. As the region continues to develop, the folding cartons market is expected to expand significantly.