Technological Innovations in Packaging

Technological advancements are reshaping the folding cartons market in China, enhancing production efficiency and product quality. Innovations such as digital printing and automation are enabling manufacturers to produce customized packaging solutions at a lower cost. In 2025, it is anticipated that the adoption of smart packaging technologies will increase, allowing for better tracking and consumer engagement. This evolution in the folding cartons market not only improves operational efficiency but also meets the growing demand for personalized packaging. As companies leverage these technologies, they are likely to gain a competitive edge in a rapidly evolving market.

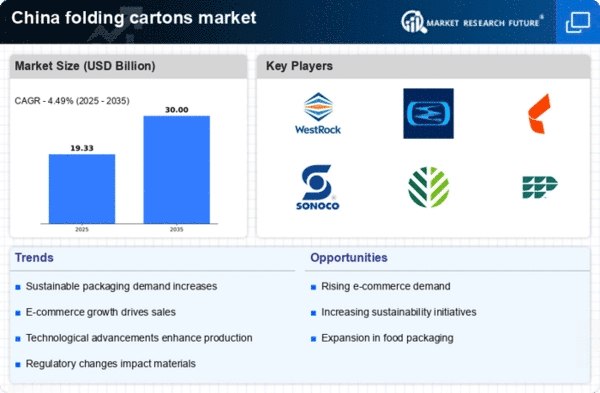

Growth of Retail and E-commerce Channels

The expansion of retail and e-commerce channels in China is a crucial driver for the folding cartons market. As online shopping continues to gain traction, the demand for efficient and attractive packaging solutions is on the rise. In 2025, it is expected that e-commerce will account for over 25% of total retail sales, necessitating innovative packaging designs that enhance the unboxing experience. The folding cartons market is responding by developing packaging that is not only functional but also visually appealing, thereby attracting consumers in a crowded marketplace. This trend underscores the importance of packaging in influencing purchasing decisions.

Rising Demand for Eco-Friendly Packaging

The increasing consumer preference for sustainable products is driving the folding cartons market in China. As environmental awareness grows, manufacturers are compelled to adopt eco-friendly materials and practices. This shift is reflected in the market, where the demand for recyclable and biodegradable folding cartons is surging. In 2025, it is estimated that the eco-friendly segment could account for over 30% of the total market share. Companies are investing in innovative designs that minimize waste and enhance recyclability, aligning with the broader sustainability goals of the nation. The folding cartons market is thus witnessing a transformation, as brands strive to meet consumer expectations while adhering to regulatory standards.

Expansion of the Food and Beverage Sector

The robust growth of the food and beverage sector in China is significantly impacting the folding cartons market. With the increasing urban population and changing lifestyles, there is a heightened demand for packaged food products. In 2025, the food and beverage segment is projected to represent approximately 40% of the total folding cartons market. This growth is driven by the rising consumption of ready-to-eat meals and convenience foods, which require effective packaging solutions. The folding cartons market is adapting to these trends by offering packaging that ensures product safety and extends shelf life, thereby catering to the evolving needs of consumers.

Regulatory Compliance and Safety Standards

The stringent regulatory environment in China is influencing the folding cartons market, as manufacturers must comply with various safety and quality standards. These regulations are designed to ensure consumer safety and environmental protection, prompting companies to invest in high-quality materials and production processes. In 2025, adherence to these regulations is expected to drive innovation within the folding cartons market, as businesses seek to differentiate themselves through compliance and quality assurance. This focus on regulatory compliance not only enhances product safety but also builds consumer trust, which is essential for long-term success in the market.