Floating Wind Turbine Size

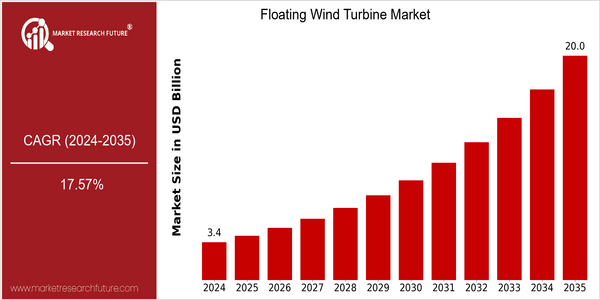

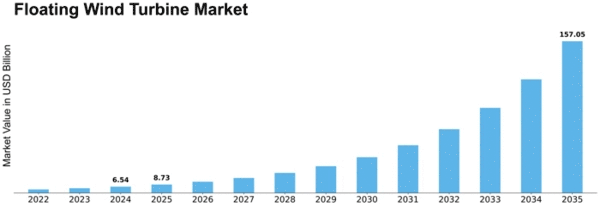

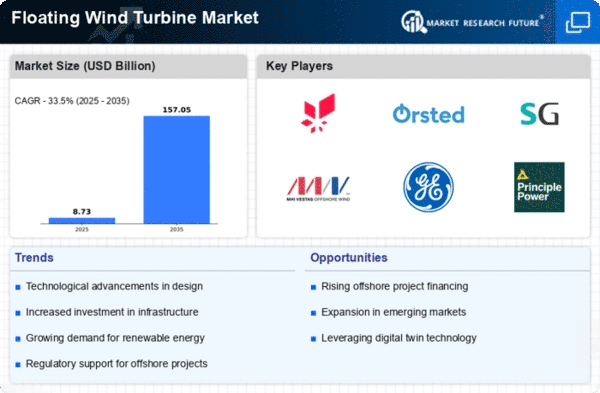

Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 3.37 Billion |

| 2035 | USD 19.99 Billion |

| CAGR (2025-2035) | 17.57 % |

Note – Market size depicts the revenue generated over the financial year

The floating wind-power market is expected to grow rapidly. The current size of the market is estimated to be $3.37 billion in 2024, and it is expected to reach $19,980,800,000 by 2035. This represents a CAGR of 17.27% from 2025 to 2035, a rapid increase, driven by the increasing investment in clean energy and the development of offshore wind energy. The need to reduce carbon dioxide emissions has also driven the demand for floating wind-power equipment, which has the advantage of using wind power in deep waters, where the traditional fixed-turbine equipment is not suitable. The key to this growth is the continuous improvement of the efficiency and reliability of floating wind-power systems, as well as the implementation of national policies to support the development of new energy. The major players in the industry, such as Equinor, rsted and Siemens-Gamesa, are constantly expanding their business scope through strategic cooperation and joint ventures. The Hywind project has set new standards for floating wind power, and rsted's investment in offshore wind farms shows the confidence in this field. These companies will continue to play an important role in the development of the floating wind-power industry.

Regional Market Size

Regional Deep Dive

The Floating Wind Turbines Market is gaining significant traction in various regions, driven by the growing demand for renewable energy and advancements in offshore wind technology. Each region has its own market dynamics, influenced by local government policies, economic conditions, and technological innovations. The market is characterized by a shift toward sustainable energy solutions, with floating wind farms being recognized for their ability to harness wind resources in deep-water areas, where traditional wind farms are not feasible. In the near future, the floating wind industry will be a promising area for growth, supported by investments and strategic collaborations.

Europe

- Europe remains at the forefront of floating wind turbine development, with countries like Norway and Scotland investing heavily in pilot projects, such as the Hywind Scotland project, which is the world's first commercial floating wind farm.

- The European Union's Green Deal and its commitment to achieving carbon neutrality by 2050 are driving regulatory support and funding for floating wind projects, fostering innovation and collaboration among key players in the market.

Asia Pacific

- Japan is making strides in floating wind technology, with the Fukushima Floating Offshore Wind Farm being a notable project that showcases the country's commitment to renewable energy and innovation in offshore wind.

- China is rapidly expanding its floating wind capacity, with significant investments from state-owned enterprises like China Three Gorges Corporation, which is expected to enhance the region's position in the global floating wind market.

Latin America

- Latin America is witnessing growing interest in offshore wind energy, with countries like Brazil exploring floating wind projects to harness its extensive coastline and favorable wind conditions.

- The Brazilian government is implementing policies to attract foreign investment in renewable energy, which could facilitate the development of floating wind farms and enhance the region's energy security.

North America

- The United States is pushing hard to develop offshore wind power, including floating wind power, and aims to develop 30 gigawatts of offshore wind by 2030. The floating wind market will be further stimulated by this initiative.

- Companies like Equinor and Ørsted are leading the charge in North America, with projects such as the 'Empire Wind' and 'Bay State Wind' aiming to leverage floating wind technology, thereby enhancing the region's renewable energy portfolio.

Middle East And Africa

- The Middle East is beginning to explore floating wind technology as part of its diversification from oil dependency, with countries like Saudi Arabia and the UAE investing in renewable energy projects, including floating wind farms.

- Regulatory frameworks are evolving in the region, with initiatives like the Saudi Vision 2030 aiming to increase the share of renewables in the energy mix, which could lead to increased adoption of floating wind technology.

Did You Know?

“Floating wind turbines can be installed in water depths exceeding 60 meters, allowing access to stronger and more consistent winds that are often found further offshore.” — International Energy Agency (IEA)

Segmental Market Size

A fast-growing part of the renewable energy market, driven by the increasing demand for sustainable energy solutions and the need to harvest offshore wind. The growth is also boosted by the development of new technology that increases the efficiency and reduces the cost of wind energy, and by regulatory measures to reduce carbon emissions. The leading regions for floating offshore wind are Europe, particularly the North Sea, and parts of the USA, where companies such as rsted and Equinor are leading the way with major projects. The market is currently at the implementation stage, with a number of notable projects such as Hywind Scotland and WindFloat Atlantic demonstrating its practical application. The main applications are for offshore power production, where floating wind farms can be located in deeper waters where they can access stronger and more predictable wind resources. However, the trend towards the increased use of sustainable energy solutions, the rise in government-mandated use of renewable energy and the growing international focus on climate change mitigation will continue to drive the growth of the market. Moreover, innovations in floating platform and mooring systems are defining the development of the industry, making it a key player in the transition to a low-carbon energy future.

Future Outlook

From 2024 to 2035, the Floating Wind Turbine Market is expected to grow at a CAGR of 17.57%. The demand for energy is increasing and the trend towards renewable energy sources. Technological innovations in floating wind technology, which increase efficiency and reduce costs, are accelerating this growth. By 2035, floating wind energy is expected to account for approximately 10-15% of the total offshore wind capacity. This is due to the fact that floating wind energy can be used in deeper waters, where fixed-base wind farms are not feasible. Various technological developments, such as improved windmills, improved materials and new anchoring systems, are expected to play a key role in this expansion. The reduction of CO2 emissions and the encouragement of sustainable energy solutions will also support the development of the market. The development of hybrid energy systems and the integration of floating wind farms with other types of renewable energy will also play an important role in the market, which will position floating wind farms as an important part of the future energy mix.

Leave a Comment