Market Share

Introduction: Navigating the Competitive Waters of Floating Wind Turbines

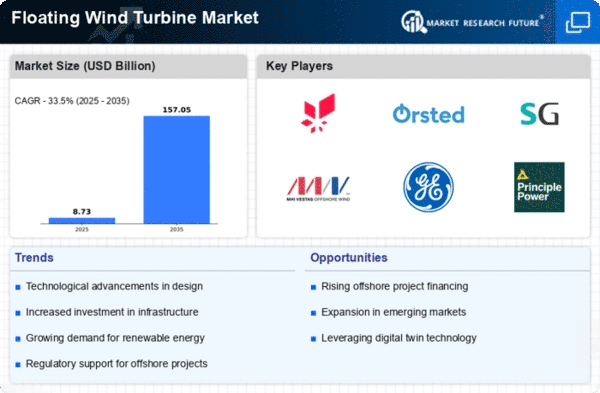

Floating windmills are experiencing a period of unparalleled growth, driven by the fast uptake of technology, the development of regulatory frameworks and the increasing demand for sustainable energy. In this growth market, the main players – windmill manufacturers, IT service companies and offshore platform suppliers – are competing for leadership by deploying advanced digital tools such as data analytics, automation and IoT. And the market is being shaken up by new entrants, especially new start-ups specializing in green technology and biometrics. Strategic trends are increasingly moving towards the development of cooperative and integrated systems that optimize performance and scalability. This will be of particular importance to C-level managers and strategic planners trying to understand the complexities of this changing market.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions encompassing design, manufacturing, and installation of floating wind turbines.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| MHI Vestas Offshore Wind | Strong engineering and manufacturing capabilities | Offshore wind turbine technology | Global |

| Siemens Gamesa Renewable Energy | Extensive experience in offshore projects | Wind turbine solutions | Global |

| General Electric | Innovative technology and large-scale production | Renewable energy solutions | Global |

| RWE | Integrated energy solutions provider | Renewable energy generation | Europe, North America |

Specialized Technology Vendors

These companies focus on specific technologies or innovations that enhance floating wind turbine performance.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Principle Power | Innovative floating platform technology | Floating wind turbine platforms | Europe, Asia |

| Blue H Technologies | Advanced digital solutions for wind energy | Digital technology for wind turbines | Global |

| Habitat Energy | Expertise in energy management systems | Energy optimization solutions | Europe |

Infrastructure & Equipment Providers

These vendors supply the necessary infrastructure and equipment to support floating wind turbine deployment.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Nordex | Strong focus on sustainability and efficiency | Wind turbine manufacturing | Europe, Americas |

| Senvion | Tailored solutions for diverse wind conditions | Wind turbine technology | Europe, Asia |

| Shell | Significant investment in renewable energy | Energy infrastructure | Global |

| EDF Renewables | Strong project development capabilities | Renewable energy projects | North America, Europe |

| Equinor | Pioneering offshore energy solutions | Offshore wind energy | Europe, North America |

| Copenhagen Infrastructure Partners | Focus on large-scale infrastructure investments | Investment in renewable energy | Global |

Emerging Players & Regional Champions

- PRINCEL POWER (U.S.A.): This company specializes in the WindFloat technology which allows the installation of windmills on floating platforms in the deeper waters. It is the winner of the contract for the WindFloat Atlantic project, located off the coast of Portugal, and has a contract for the WindFloat Atlantic project, off the coast of Portugal, which will demonstrate the feasibility of floating solutions in the harshest marine environments.

- Norway: Concentrates on the Hywind concept, which will be the world's first floating wind farm. Recently widened its portfolio with the Hywind Tampen project, showcasing the ability to integrate floating wind with oil and gas production, thereby complementing the traditional energy sector.

- COBRA GROUP (Spain): Floating platform design, has been awarded a contract in Spain and Portugal. Challenges established suppliers by focusing on cost-effectiveness and local supply chains.

- MHI Vestas (Denmark): Known for its V164-800 wind-turbine, MHI Vestas is now entering the floating-wind-power market. It is primarily interested in hybrid solutions that combine floating wind with other renewable energy sources. Its recent collaboration with a number of European companies puts it in a strong position to compete with the established wind-turbine manufacturers.

Regional Trends: In 2024, the Floating Wind Turbines Market is expected to grow at a CAGR of 16% in Europe, especially in countries such as Norway, Portugal and Spain, owing to the increasing investment in the development of renewable energy sources. The technological specialization is shifting towards hybrid solutions that combine floating wind with other energy sources, thus reducing costs and enhancing energy efficiency. Japan and South Korea are also beginning to adopt floating wind technology. This reflects a growing trend towards sustainable energy solutions around the world.

Collaborations & M&A Movements

- The agreement between Siemens Gamesa and rsted consists of the joint development of floating wind-power technology, which will reduce costs and increase the efficiency of offshore wind farms, thereby strengthening their position in the growing field of renewable energy.

- Equinor bought a half interest in the floating wind farm from EDP-Renováveis. The aim was to take advantage of EDP-Renováveis' experience in the field of floating plants and to strengthen its position in the offshore wind sector, where support for the development of offshore wind power is growing.

- MHI Vestas and Principle Power have entered into a partnership to deploy their floating wind power solutions on the U.S. West Coast.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Floating Platform Design | Equinor, Principle Power | The HYWIND project is a demonstration of the most advanced floating platform technology, demonstrating its stability in harsh marine environments. Windfloat has been successfully tested in the Portuguese seas, demonstrating its versatility in various sea conditions. |

| Turbine Technology | Siemens Gamesa, GE Renewable Energy | Siemens Gamesa's SG 14-222 DD turbine is designed for high efficiency and reliability in floating applications. GE's Haliade-X turbine has set records for energy output, proving its capability in offshore settings. |

| Installation and Maintenance | Van Oord, Subsea 7 | Van Oord has extensive experience in offshore wind installation, utilizing innovative vessels for efficient deployment. Subsea 7's expertise in subsea engineering enhances maintenance operations for floating turbines. |

| Grid Integration | DNV GL, ABB | DNV GL provides comprehensive solutions for grid integration, ensuring stability and reliability of energy supply. ABB's technology facilitates seamless connection of floating wind farms to existing grids. |

| Environmental Impact Assessment | Ramboll, Wood Group | Ramboll's extensive environmental studies for offshore projects ensure compliance with regulations and stakeholder engagement. Wood Group's sustainability assessments help optimize project designs to minimize ecological footprints. |

| Energy Storage Solutions | Siemens, Tesla | Siemens is integrating energy storage with floating wind projects to enhance energy reliability. Tesla's battery technology is being explored for use in offshore wind applications, providing backup power and grid stability. |

Conclusion: Navigating the Floating Wind Turbine Landscape

In 2024, the Floating Wind Turbine Market is expected to show a fragmented structure, with the market dominated by both new and old players. The old ones use their experience and resources to develop new products, while the new ones use their new technology to invent new products. The prevailing trend in the global Floating Wind Turbine Market is the increasing emphasis on government support and green development, especially in Europe and Asia-Pacific, which have become hotspots for investment. The market is developing rapidly, and the demand for green energy is growing. To meet the increasing demand, vendors must strategically enhance their abilities in artificial intelligence, automation, and flexibility. The ability to change and the ability to integrate new technology are the key to leadership in this fast-changing industry.

Leave a Comment