Market Trends

Introduction

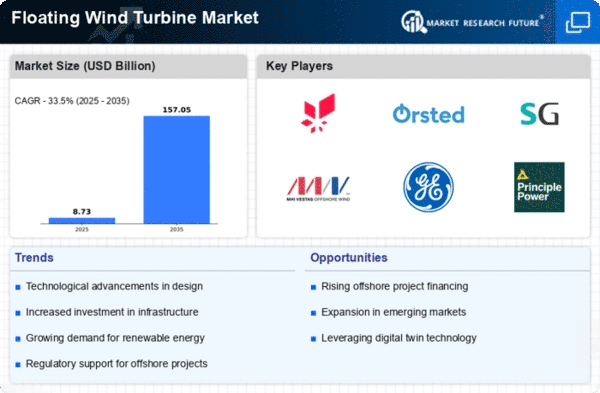

By the time we reach 2024, the Floating Wind Turbine Market is on the verge of a major transformation, driven by a combination of macroeconomic factors. The new wind power technology, which will be based on the use of offshore wind farms, will have been developed. The efficiency of wind power, and the costs of generating it, are decreasing, which will enable the floating wind industry to become more viable. At the same time, pressures to reduce carbon emissions will lead governments to incentivise the use of renewable energy, including offshore wind power. In addition, changes in the attitudes of consumers towards the use of sustainable energy will drive up demand for clean power solutions. These trends will have a strategic importance for the industry as they will not only influence investment decisions, but also the positioning of the market in a rapidly changing energy landscape.

Top Trends

-

Increased Investment in R&D

A large number of the world's leading companies are now investing heavily in the research and development of floating wind-power plants. Among others, companies like Siemens-Gamesa have set aside large budgets to increase the efficiency of the windmills and reduce costs. The result is expected to be a decrease of the levelized cost of energy of up to 20 percent over the next few years. With further technological development, the operating efficiency of floating wind-power plants will probably increase and become more competitive with other energy sources. -

Government Incentives and Policies

There are now several countries in the world that are making an effort to promote floating wind energy. Europe has ambitious goals for the offshore wind power industry, aiming for 300 GW by 2050. These goals have a positive effect on the industry, attracting investment and encouraging collaboration among industry leaders. In the future, the regulatory environment is expected to evolve, with the potential for a shortened approval process and increased approvals. -

Technological Advancements in Turbine Design

The efficiency of floating wind-turbines is largely increased by new developments in the construction of the rotor, in the shape of the blades and in the material of the rotor. MHI Vestas has developed a design that can be used in harsher marine environments, which is necessary for installation in deeper waters. These developments will substantially increase the efficiency of the rotor and thus increase the output of floating wind-farms. -

Expansion into Emerging Markets

The floating windmill is a new type of wind-power technology. It is now being adopted in the emerging economies of Asia and Africa. Japan and South Korea are investing heavily in offshore wind, and they intend to install several gigawatts by 2030. This expansion will diversify the market, creating new opportunities for international cooperation, which will enhance the overall competitiveness of the floating windmill sector. -

Focus on Sustainability and Environmental Impact

In the case of floating wind projects, the emphasis is on the sustainable development of the activity. The companies are increasingly putting the emphasis on eco-friendly practices. For example, Shell has committed itself to reducing the environmental impact of its offshore projects. This trend will have a significant influence on the choice of project and on the operational strategy, since the demands for transparency and responsibility on the environment are increasing. -

Integration with Energy Storage Solutions

To combat this problem, a combination of floating wind power and energy storage systems is being considered. EDF Renewables is exploring the development of hybrid systems that combine wind energy with storage batteries. This solution could increase the stability of the grid and the availability of the energy produced, thus making it possible to supply electricity from floating wind in areas where demand varies. -

Collaboration and Partnerships

In the same way, the collaboration between the players of the industry is becoming more common to share their knowledge and resources. For example, Equinor and Copenhagen Infrastructure Partners have joined forces to develop large floating wind farms. The establishment of such associations is likely to accelerate the timetables and reduce costs, thus promoting a more cooperative climate in the floating wind industry. -

Digitalization and Smart Technologies

IT technology, the Internet of Things and artificial intelligence, are the keys to the operation of floating wind farms. Companies use the data to optimize the performance of the machines and to prevent breakdowns. It is hoped that this trend will reduce operating costs and downtime and thus increase the long-term profitability of floating wind farms. -

Supply Chain Resilience and Local Manufacturing

The floating wind industry is building up a strong and reliable supply chain and is promoting local production. Companies are investing in local factories in order to reduce transportation costs and enhance supply chain security. Local production is a trend that is expected to create jobs and stimulate local economies. -

Increased Public Awareness and Acceptance

Public awareness and acceptance of floating wind power are on the increase, thanks to educational campaigns and community involvement. More and more people are recognizing the advantages of renewable energy. Support for floating wind projects will also grow. This will lead to a better climate for project approvals and increased investment, thus strengthening the market.

Conclusion: Navigating the Floating Wind Turbine Landscape

Competition in the floating wind-turbine market in 2024 will be very fierce. In this sector, the established companies will be able to take advantage of their experience and resources, while the new entrants will bring in the most advanced technology. In the geographical distribution of the industry, the trend will be towards more sustainable practices and greater regulatory support, particularly in Europe and Asia-Pacific, which will become the hotspots for investment. The suppliers must strategically develop their capabilities in artificial intelligence, automation, and adaptability, to meet the rising demand for sustainable energy. In this fast-changing market, the ability to respond to the market’s changing demands and to integrate new technology will be the key to survival.

Leave a Comment