Regulatory Support and Incentives

The Direct Drive Wind Turbine Market benefits from robust regulatory support and incentives aimed at promoting renewable energy sources. Governments across various regions are implementing policies that encourage the adoption of wind energy, including tax credits, grants, and feed-in tariffs. Such measures are designed to reduce the financial burden on developers and investors, making direct drive wind turbines a more attractive option. For example, recent legislation in several countries mandates a certain percentage of energy to be sourced from renewable technologies, which could potentially increase the market share of direct drive systems. This supportive regulatory environment is likely to catalyze investment and innovation within the industry.

Cost Competitiveness of Wind Energy

The Direct Drive Wind Turbine Market is also influenced by the cost competitiveness of wind energy compared to traditional fossil fuels. As the cost of wind energy continues to decline, driven by advancements in turbine technology and economies of scale, direct drive systems are becoming increasingly viable. Recent data suggests that the levelized cost of energy (LCOE) for onshore wind has dropped by nearly 50% over the past decade, making it one of the most affordable energy sources available. This economic advantage is likely to attract more investments into the direct drive segment, as stakeholders seek to capitalize on the favorable market conditions.

Increased Demand for Renewable Energy

The Direct Drive Wind Turbine Market is witnessing a heightened demand for renewable energy solutions, driven by global efforts to combat climate change. As nations commit to reducing carbon emissions, the transition to wind energy becomes increasingly critical. Direct drive wind turbines, known for their efficiency and lower environmental impact, are positioned to meet this demand. According to recent estimates, the share of wind energy in the overall energy mix is expected to rise significantly, potentially reaching 20% by 2030. This trend indicates a growing acceptance of wind technology, which could further bolster the direct drive segment of the market.

Growing Awareness of Energy Independence

The Direct Drive Wind Turbine Market is benefiting from a growing awareness of energy independence among nations. As geopolitical tensions and energy security concerns rise, countries are increasingly looking to diversify their energy sources. Direct drive wind turbines offer a reliable and sustainable solution that can reduce dependence on imported fossil fuels. This shift towards self-sufficiency in energy production is likely to drive investments in wind energy infrastructure, including direct drive systems. The potential for local job creation and economic development associated with wind projects further enhances their appeal, suggesting a promising outlook for the direct drive wind turbine market.

Technological Advancements in Direct Drive Wind Turbines

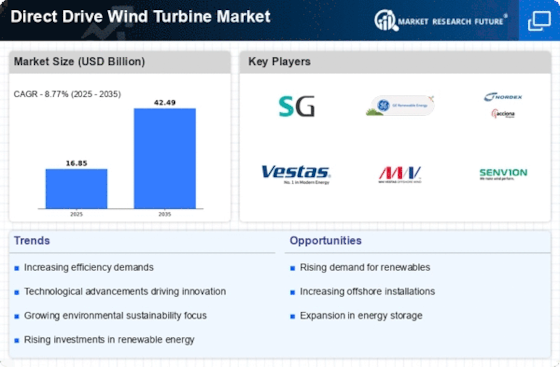

The Direct Drive Wind Turbine Market is experiencing a surge in technological advancements that enhance turbine efficiency and reliability. Innovations such as permanent magnet generators and advanced control systems are being integrated into turbine designs, which may lead to improved energy capture and reduced maintenance costs. For instance, the implementation of direct drive systems eliminates the need for a gearbox, which is a common point of failure in traditional turbines. This shift not only increases the operational lifespan of the turbines but also reduces downtime, thereby maximizing energy production. As a result, the market is projected to grow at a compound annual growth rate of approximately 8% over the next five years, driven by these technological improvements.