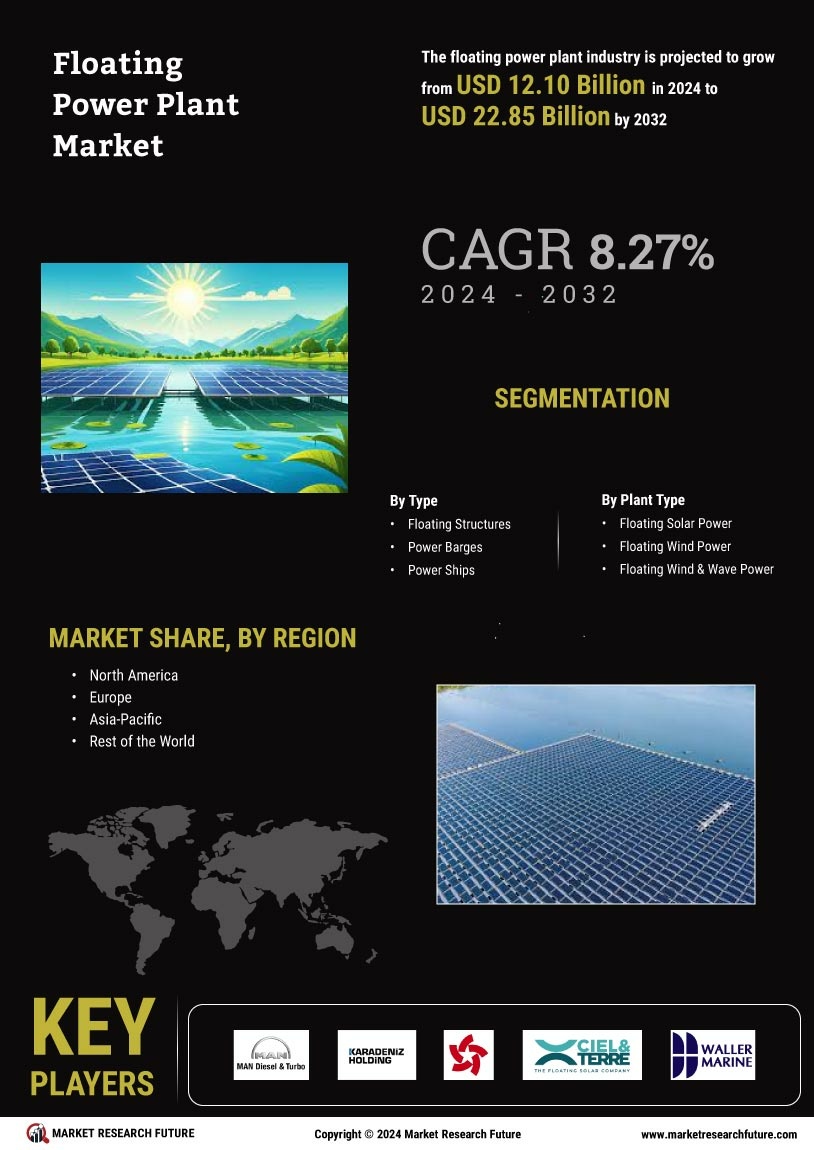

Rising Energy Demand

The Floating Power Plant Market is experiencing a surge in demand for energy due to increasing population and industrialization. As urban areas expand, the need for reliable and sustainable energy sources becomes paramount. According to recent estimates, energy consumption is projected to rise by approximately 30% by 2030. This escalating demand drives the adoption of floating power plants, which can be deployed in various water bodies, providing flexibility and efficiency. The ability to harness renewable energy sources, such as solar and wind, further enhances the appeal of floating power plants. Consequently, the Floating Power Plant Market is likely to witness significant growth as stakeholders seek innovative solutions to meet energy needs.

Technological Innovations

Technological advancements play a crucial role in shaping the Floating Power Plant Market. Innovations in floating structures, energy conversion technologies, and renewable energy integration are enhancing the efficiency and viability of floating power plants. For instance, the development of advanced floating solar panels and wind turbines has improved energy capture and reduced costs. The market is projected to grow at a compound annual growth rate of around 15% over the next five years, driven by these technological innovations. Furthermore, the integration of smart grid technologies allows for better energy management and distribution, making floating power plants more attractive to investors and operators alike.

Environmental Sustainability

The growing emphasis on environmental sustainability is a significant driver for the Floating Power Plant Market. As concerns about climate change and pollution intensify, there is a pressing need for cleaner energy solutions. Floating power plants, which can utilize renewable energy sources, offer a viable alternative to traditional fossil fuel-based power generation. The ability to minimize land use and reduce ecological disruption further enhances their appeal. According to recent studies, floating solar installations can reduce water evaporation and improve water quality, making them environmentally beneficial. This alignment with sustainability goals is likely to attract investments and support for the Floating Power Plant Market.

Energy Security and Resilience

Energy security remains a critical concern for many regions, driving interest in the Floating Power Plant Market. Floating power plants can be strategically deployed to enhance energy resilience, particularly in areas prone to natural disasters or energy supply disruptions. Their mobility allows for rapid deployment in response to emergencies, ensuring a stable energy supply. Additionally, floating power plants can diversify energy sources, reducing reliance on a single energy type. This diversification is essential for maintaining energy security in an increasingly volatile global energy landscape. As such, the Floating Power Plant Market is likely to benefit from heightened awareness of energy security issues.

Government Initiatives and Incentives

Government policies and incentives are pivotal in propelling the Floating Power Plant Market forward. Many governments are implementing supportive regulations and financial incentives to promote renewable energy projects. For example, subsidies for renewable energy installations and tax breaks for floating power plant projects are becoming increasingly common. These initiatives not only encourage investment but also facilitate the development of infrastructure necessary for floating power plants. As a result, the market is expected to expand as more stakeholders recognize the benefits of aligning with governmental objectives for sustainable energy production. This supportive environment is likely to foster innovation and investment in the Floating Power Plant Market.