Geopolitical Factors

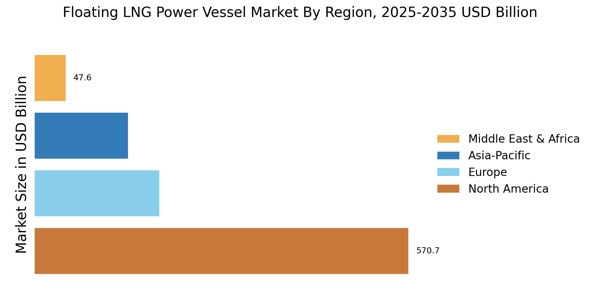

The Floating LNG Power Vessel Market is also influenced by geopolitical dynamics that affect energy supply and demand. Regions rich in natural gas reserves are increasingly looking to export LNG to meet the energy needs of importing countries. Floating LNG power vessels provide a strategic advantage by enabling the rapid deployment of energy solutions in areas with limited infrastructure. This flexibility is particularly valuable in regions experiencing political instability or conflict, where traditional energy supply chains may be disrupted. As countries seek to diversify their energy sources and reduce reliance on a single supplier, the demand for floating LNG power vessels is likely to increase, positioning them as a critical component of the global energy landscape.

Rising Energy Demand

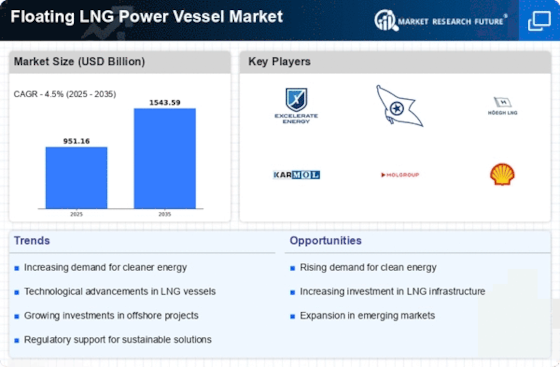

The Floating LNG Power Vessel Market is experiencing a surge in demand due to the increasing global energy requirements. As populations grow and economies expand, the need for reliable and efficient energy sources becomes paramount. Floating LNG power vessels offer a flexible solution, allowing for the rapid deployment of energy infrastructure in regions where traditional land-based facilities may be impractical. According to recent estimates, the demand for LNG is projected to grow at a compound annual growth rate of approximately 5% over the next decade. This trend indicates a robust market potential for floating LNG power vessels, as they can provide a quick response to energy shortages and support energy security initiatives.

Regulatory Frameworks

The Floating LNG Power Vessel Market is shaped by evolving regulatory frameworks that support the development and deployment of LNG technologies. Governments are increasingly recognizing the strategic importance of LNG in achieving energy independence and security. Policies that promote the use of LNG, such as tax incentives and streamlined permitting processes, are likely to encourage investment in floating LNG power vessels. Furthermore, international agreements aimed at reducing carbon emissions are creating a favorable environment for LNG adoption. As regulatory bodies establish clearer guidelines and standards, the floating LNG power vessel market is expected to experience accelerated growth, driven by enhanced investor confidence and market stability.

Technological Innovations

The Floating LNG Power Vessel Market is benefiting from rapid technological advancements that enhance the efficiency and reliability of LNG operations. Innovations in floating production storage and offloading (FPSO) systems, as well as improvements in LNG regasification technologies, are making floating LNG power vessels more competitive. These advancements not only reduce operational costs but also improve safety and environmental performance. For instance, the integration of digital technologies and automation in vessel operations is streamlining processes and minimizing human error. As these technologies continue to evolve, they are expected to attract further investment into the floating LNG power vessel sector, thereby expanding its market presence.

Environmental Considerations

The Floating LNG Power Vessel Market is significantly influenced by the increasing emphasis on environmental sustainability. As nations strive to reduce carbon emissions and transition to cleaner energy sources, LNG is often viewed as a bridge fuel that can facilitate this shift. Floating LNG power vessels, which emit fewer pollutants compared to traditional fossil fuels, are becoming an attractive option for countries aiming to meet their climate goals. The International Energy Agency has noted that LNG can play a crucial role in reducing greenhouse gas emissions, thereby enhancing the appeal of floating LNG power vessels in the energy mix. This growing environmental consciousness is likely to drive investment and innovation within the industry.