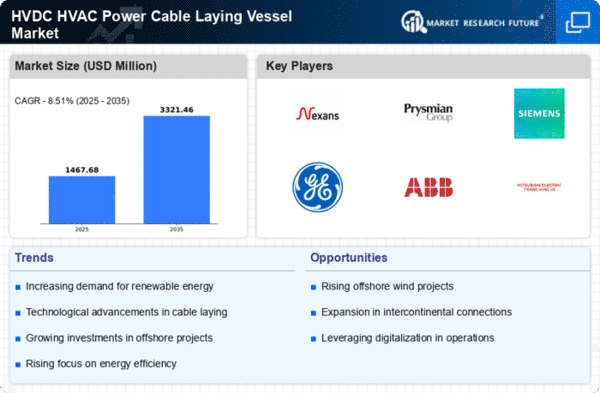

North America : Growing Infrastructure Investments

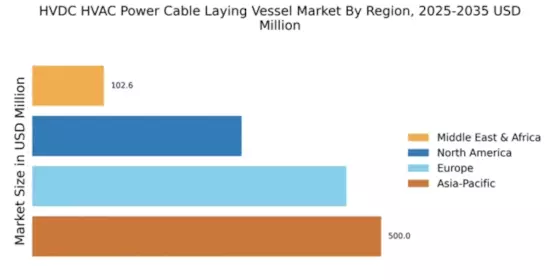

The North American HVDC HVAC power cable laying vessel market is poised for growth, driven by significant investments in renewable energy infrastructure and grid modernization. With a market size of $300.0 million, the region is focusing on enhancing its energy transmission capabilities to meet increasing demand. Regulatory support for clean energy initiatives is further catalyzing this growth, as states aim to reduce carbon emissions and transition to sustainable energy sources. Leading the charge in this market are the United States and Canada, where major players like General Electric and Siemens are actively involved. The competitive landscape is characterized by collaborations and partnerships aimed at advancing technology and efficiency in cable laying operations. As the region prioritizes energy security and sustainability, the presence of key players will be crucial in shaping the future of HVDC solutions.

Europe : Innovation and Sustainability Focus

Europe is at the forefront of the HVDC HVAC power cable laying vessel market, with a market size of €450.0 million. The region's commitment to sustainability and renewable energy sources is driving demand for advanced cable laying technologies. Regulatory frameworks, such as the European Green Deal, are incentivizing investments in infrastructure that supports energy transition, making Europe a key player in the global market. Countries like Germany, France, and the Netherlands are leading the charge, with major companies such as Nexans and Prysmian Group dominating the landscape. The competitive environment is marked by innovation, as firms invest in R&D to enhance efficiency and reduce costs. The presence of established players and supportive regulations positions Europe as a critical hub for HVDC technology development and deployment.

Asia-Pacific : Emerging Powerhouse in HVDC

The Asia-Pacific region is emerging as a powerhouse in the HVDC HVAC power cable laying vessel market, boasting the largest market share at $500.0 million. Rapid urbanization, industrialization, and a growing focus on renewable energy are key drivers of this growth. Governments are implementing supportive policies and regulations to enhance energy infrastructure, which is crucial for meeting the region's increasing energy demands. China, Japan, and India are leading countries in this market, with significant investments in HVDC technology. Major players like Mitsubishi Electric and ABB are actively involved in projects aimed at improving energy transmission efficiency. The competitive landscape is dynamic, with a focus on innovation and collaboration among key stakeholders to address the challenges of energy distribution in densely populated areas.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa (MEA) region presents a unique opportunity in the HVDC HVAC power cable laying vessel market, with a market size of $102.58 million. The region's rich natural resources and increasing investments in energy infrastructure are driving demand for advanced cable laying solutions. Regulatory initiatives aimed at diversifying energy sources and enhancing grid connectivity are further supporting market growth. Countries like South Africa and the UAE are at the forefront, with investments in renewable energy projects and infrastructure development. The competitive landscape is characterized by a mix of local and international players, including Subsea 7 and Van Oord, who are focusing on innovative solutions to meet the region's energy needs. As the MEA region continues to evolve, the potential for HVDC technology adoption remains significant.