Growing Adoption in Healthcare Sector

The healthcare sector is increasingly recognizing the potential of fingerprint biometrics, which serves as a significant driver for the Fingerprint Biometrics Market. The need for secure patient identification and access to medical records is paramount in healthcare settings. Biometric authentication helps mitigate risks associated with patient misidentification and fraud, ensuring that healthcare providers can deliver accurate and timely care. The market for biometric solutions in healthcare is projected to grow substantially, with estimates suggesting a growth rate of around 12% annually over the next few years. Hospitals and clinics are adopting fingerprint biometrics for various applications, including patient check-in, medication administration, and access control to sensitive areas. This trend not only enhances security but also streamlines operations, making it a vital component of modern healthcare systems.

Government Initiatives and Regulations

Government initiatives and regulations are playing a crucial role in shaping the Fingerprint Biometrics Market. Many governments are implementing policies that encourage the adoption of biometric technologies for identification and verification purposes. For instance, initiatives aimed at enhancing national security and border control are driving the integration of fingerprint biometrics in various governmental processes. Additionally, regulations concerning data protection and privacy are prompting organizations to adopt biometric solutions that comply with legal standards. The market is likely to benefit from these initiatives, as they create a conducive environment for the deployment of fingerprint biometrics in public and private sectors. Furthermore, the establishment of standards for biometric data management is expected to enhance consumer trust, thereby accelerating market growth.

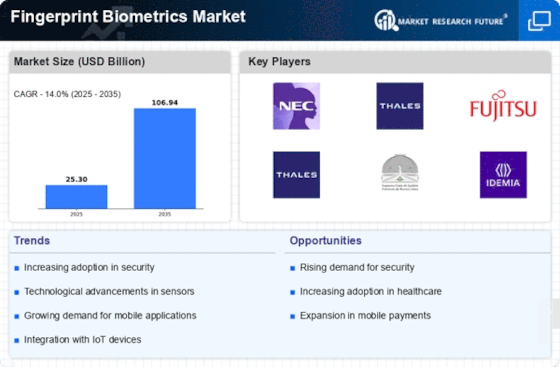

Rising Demand for Enhanced Security Solutions

The Fingerprint Biometrics Market is experiencing a notable surge in demand for enhanced security solutions across various sectors. As cyber threats and identity theft incidents continue to rise, organizations are increasingly adopting biometric technologies to safeguard sensitive information. The market is projected to grow at a compound annual growth rate of approximately 14% over the next five years, driven by the need for robust authentication methods. This trend is particularly evident in financial services, where biometric authentication is becoming a standard practice to prevent fraud. Furthermore, the integration of fingerprint biometrics into access control systems is gaining traction, as businesses seek to protect their physical assets. The growing awareness of the limitations of traditional password systems further propels the adoption of fingerprint biometrics, making it a pivotal driver in the market.

Increasing Use in Law Enforcement and Forensics

The Fingerprint Biometrics Market is witnessing increased utilization in law enforcement and forensics, which serves as a critical driver for market expansion. Law enforcement agencies are leveraging fingerprint biometrics for criminal identification and background checks, enhancing their ability to solve cases efficiently. The accuracy and reliability of fingerprint recognition technology make it an indispensable tool in forensic investigations. As the demand for advanced crime-solving techniques rises, the market for fingerprint biometrics in law enforcement is expected to grow significantly. Furthermore, the integration of biometric databases with law enforcement systems is facilitating quicker access to critical information, thereby improving response times. This trend indicates a robust future for fingerprint biometrics in the criminal justice system, as agencies continue to adopt innovative technologies to enhance public safety.

Technological Advancements in Fingerprint Recognition

Technological advancements in fingerprint recognition are significantly influencing the Fingerprint Biometrics Market. Innovations such as capacitive, optical, and ultrasonic fingerprint sensors are enhancing the accuracy and speed of biometric authentication. These advancements are not only improving user experience but also expanding the applicability of fingerprint biometrics in various devices, including smartphones, tablets, and security systems. The introduction of artificial intelligence and machine learning algorithms is further refining the capabilities of fingerprint recognition systems, allowing for better performance in diverse environmental conditions. As a result, the market is witnessing an influx of new products that cater to both consumer and enterprise needs. The increasing integration of these technologies into everyday devices is expected to drive market growth, as consumers and businesses alike seek more reliable and efficient security solutions.