Integration with IoT Devices

The integration of fingerprint biometrics with Internet of Things (IoT) devices is emerging as a key driver for the market. As smart devices proliferate in Canada, the need for secure authentication methods becomes paramount. Fingerprint biometrics offers a seamless way to enhance security in IoT applications, such as smart home systems and wearable technology. The market for IoT devices in Canada is expected to exceed $20 billion by 2026, suggesting a substantial opportunity for fingerprint biometrics to play a critical role in securing these interconnected systems. This integration is likely to foster innovation and drive further growth in the fingerprint biometrics market.

Increasing Cybersecurity Threats

The fingerprint biometrics market is experiencing growth due to the rising incidence of cyber threats in Canada. As organizations face increasing risks from data breaches and identity theft, the demand for robust security solutions has surged. Fingerprint biometrics offers a reliable method for user authentication, which is crucial for protecting sensitive information. In 2025, the Canadian cybersecurity market is projected to reach approximately $6 billion, indicating a strong correlation between cybersecurity needs and the adoption of biometric technologies. This trend suggests that businesses are prioritizing advanced security measures, thereby driving the fingerprint biometrics market forward.

Consumer Awareness and Acceptance

Consumer awareness regarding the benefits of biometric security is increasing, which is positively influencing the fingerprint biometrics market. As individuals become more informed about the vulnerabilities associated with traditional passwords, they are more inclined to adopt biometric solutions. Surveys indicate that approximately 70% of Canadians express a preference for biometric authentication over conventional methods. This shift in consumer behavior is likely to encourage businesses to implement fingerprint biometrics as a primary security measure, thereby expanding the market's reach and acceptance across various industries.

Government Initiatives for Digital Identity

Government initiatives aimed at enhancing digital identity verification are significantly impacting the fingerprint biometrics market. In Canada, various programs are being implemented to streamline identity management processes, particularly in public services and financial sectors. The Canadian government has allocated substantial funding to improve digital infrastructure, which includes biometric systems. This investment is expected to bolster the adoption of fingerprint biometrics, as it provides a secure and efficient means of identity verification. The market is likely to benefit from these initiatives, as they promote the integration of biometric solutions in governmental operations.

Technological Advancements in Biometric Systems

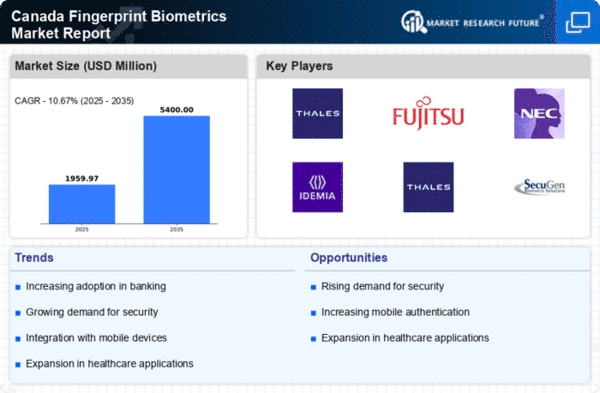

Technological advancements are propelling the fingerprint biometrics market in Canada. Innovations in sensor technology, data processing, and machine learning algorithms are enhancing the accuracy and speed of fingerprint recognition systems. As these technologies evolve, they become more accessible and cost-effective for various applications, including mobile devices and access control systems. The market is projected to grow at a CAGR of around 15% from 2025 to 2030, driven by these advancements. This growth indicates a strong potential for fingerprint biometrics to become a standard security measure across multiple sectors.