Growing Emphasis on Risk Management

In an increasingly volatile economic environment, the emphasis on risk management has intensified, significantly impacting the Financial Consulting Software Market. Financial institutions and corporations are prioritizing risk assessment and mitigation strategies, leading to a surge in demand for software that can effectively analyze and manage risks. The market for risk management software is expected to witness a growth rate of around 12% annually, reflecting the urgent need for tools that can provide comprehensive risk analysis. This trend indicates that financial consulting software must evolve to incorporate advanced risk management features, ensuring that clients can navigate uncertainties with confidence.

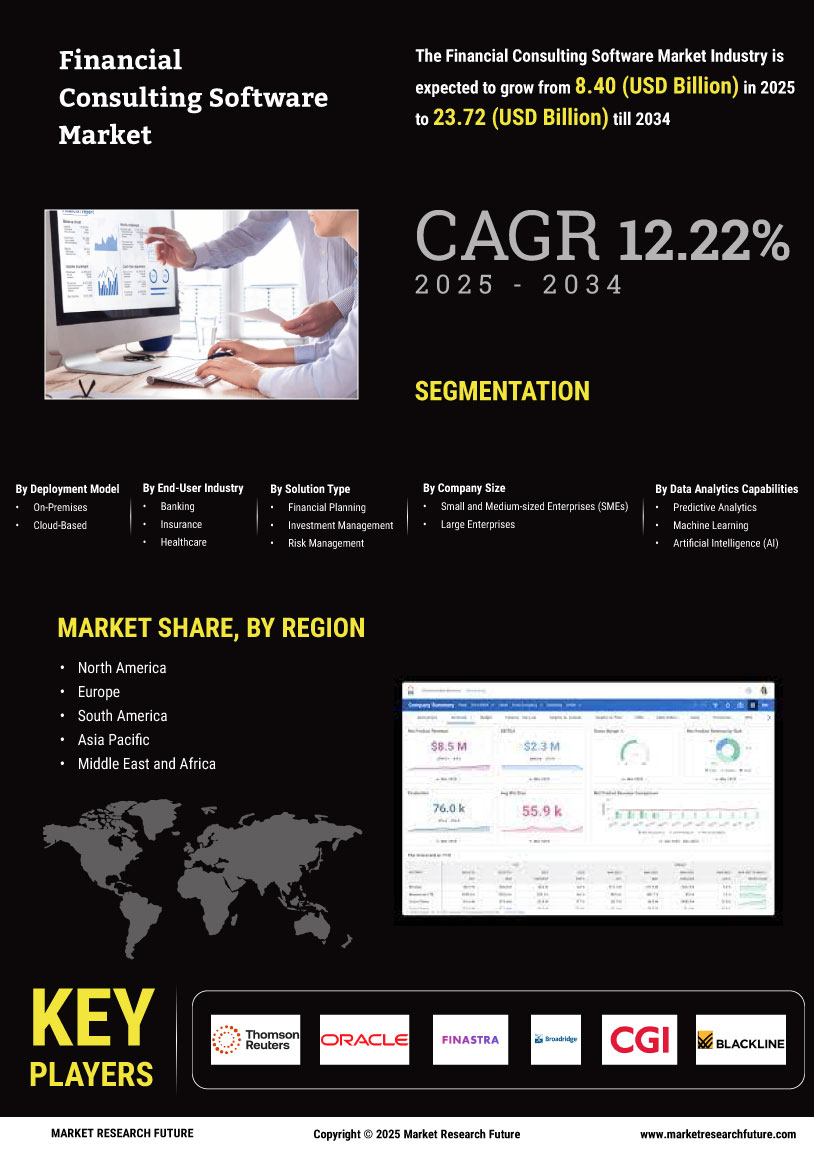

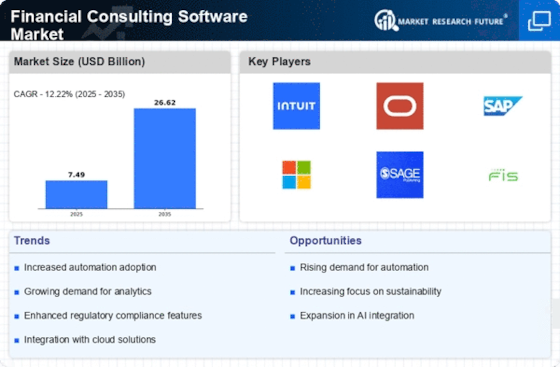

Rising Demand for Financial Analytics

The increasing complexity of financial markets has led to a rising demand for advanced financial analytics tools within the Financial Consulting Software Market. Organizations are seeking software solutions that can provide real-time insights and predictive analytics to enhance decision-making processes. According to recent data, the financial analytics segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for businesses to leverage data for strategic planning and risk management. As firms strive to remain competitive, the integration of sophisticated analytics into financial consulting software becomes essential, thereby propelling the overall market forward.

Increased Focus on Client-Centric Solutions

The Financial Consulting Software Market is witnessing a shift towards client-centric solutions, as firms recognize the importance of tailoring services to meet individual client needs. This trend is driven by the growing expectation for personalized financial advice and services. Data indicates that companies offering customized software solutions are likely to see a 20% increase in client satisfaction and retention rates. As a result, financial consulting software providers are increasingly investing in features that allow for greater customization and flexibility, ensuring that they can deliver value-added services that resonate with clients.

Regulatory Compliance and Reporting Requirements

The evolving landscape of regulatory compliance is a critical driver in the Financial Consulting Software Market. As regulations become more stringent, financial institutions are compelled to adopt software solutions that facilitate compliance and streamline reporting processes. The market for compliance-related software is projected to grow at a rate of 8% annually, reflecting the increasing need for tools that can help organizations navigate complex regulatory frameworks. This trend underscores the necessity for financial consulting software to integrate compliance features, enabling firms to mitigate risks associated with non-compliance and enhance their operational efficiency.

Technological Advancements in Software Development

Technological advancements are reshaping the Financial Consulting Software Market, as innovations in software development enable the creation of more efficient and user-friendly solutions. The rise of machine learning and data analytics technologies is particularly noteworthy, as these tools enhance the capabilities of financial consulting software. Recent statistics suggest that the adoption of these technologies could lead to a 15% increase in operational efficiency for firms utilizing advanced software solutions. As technology continues to evolve, financial consulting software must adapt to incorporate these advancements, ensuring that it meets the evolving needs of clients and remains competitive in the market.