Increased Regulatory Scrutiny

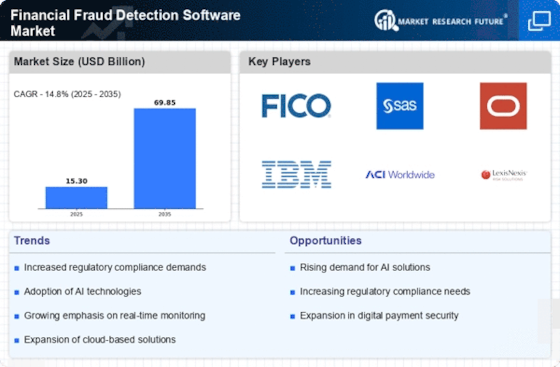

The Financial Fraud Detection Software Market is significantly influenced by the heightened regulatory scrutiny surrounding financial transactions. Governments and regulatory bodies are imposing stricter compliance requirements to combat financial crimes, which necessitates the adoption of effective fraud detection solutions. Organizations are compelled to invest in software that not only meets regulatory standards but also enhances their overall risk management strategies. This trend is expected to drive the growth of the Financial Fraud Detection Software Market as companies seek to avoid hefty fines and reputational damage associated with non-compliance. The ongoing evolution of regulations will likely further stimulate demand for advanced detection tools.

Rising Incidence of Financial Fraud

The increasing prevalence of financial fraud across various sectors appears to be a primary driver for the Financial Fraud Detection Software Market. Reports indicate that financial fraud losses have surged, with estimates suggesting that organizations could lose billions annually due to fraudulent activities. This alarming trend compels businesses to invest in advanced detection software to safeguard their assets and maintain consumer trust. As fraudsters become more sophisticated, the demand for innovative solutions that can identify and mitigate risks in real-time is likely to grow. Consequently, the Financial Fraud Detection Software Market is expected to expand as organizations prioritize the implementation of robust fraud detection mechanisms.

Expansion of Digital Payment Systems

The rapid expansion of digital payment systems is a significant driver for the Financial Fraud Detection Software Market. As more consumers and businesses adopt online payment methods, the potential for fraudulent activities increases. This shift necessitates the implementation of robust fraud detection solutions to protect sensitive financial information. The market is witnessing a surge in demand for software that can effectively monitor and analyze digital transactions in real-time. As the trend towards cashless transactions continues, the Financial Fraud Detection Software Market is likely to grow, with organizations seeking to enhance their fraud prevention measures to ensure secure payment processing.

Growing Awareness of Cybersecurity Threats

As organizations become increasingly aware of the cybersecurity threats posed by financial fraud, the Financial Fraud Detection Software Market is experiencing notable growth. The rise in cyberattacks targeting financial institutions has heightened the urgency for effective fraud detection solutions. Companies are recognizing that traditional security measures may no longer suffice, leading to a shift towards more comprehensive fraud detection software. This awareness is likely to drive investments in advanced technologies that can provide real-time monitoring and threat detection. Consequently, the Financial Fraud Detection Software Market is expected to expand as businesses prioritize cybersecurity in their operational strategies.

Technological Advancements in Detection Methods

Technological innovations, particularly in machine learning and artificial intelligence, are transforming the Financial Fraud Detection Software Market. These advancements enable the development of sophisticated algorithms that can analyze vast amounts of data to detect anomalies indicative of fraudulent behavior. The integration of predictive analytics allows organizations to anticipate potential fraud before it occurs, thereby reducing losses. As businesses increasingly recognize the value of leveraging technology to enhance their fraud detection capabilities, the market is poised for significant growth. The Financial Fraud Detection Software Market is likely to witness a surge in demand for solutions that incorporate these cutting-edge technologies.