Market Analysis

In-depth Analysis of Filled Fluoropolymer Market Industry Landscape

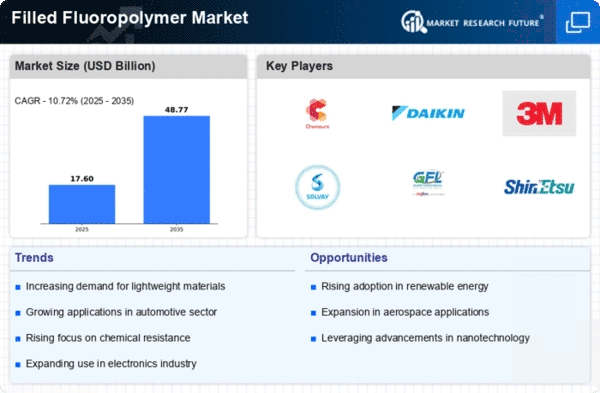

Multiple factors shape the filled fluoropolymer industry's market aspects and patterns. Due to their high temperature resistance, compound idleness, and low grating, filled fluoropolymers like PTFE (polytetrafluoroethylene) and other fluorinated materials have distinguished themselves in current applications. End-use industries including cars, devices, and drug delivery are driving the market.

Recently, filled fluoropolymers have become popular in the vehicle industry, notably for fastening applications and parts that require synthetic blockage. The growing emphasis on eco-friendliness, reduced discharges, and the need for robust materials in harsh working conditions drive this trend. Due to their dielectric qualities and heat resistance, filled fluoropolymers are increasingly used in electronics assembly, circuit security, and protection. Superior performance materials such filled fluoropolymers are in demand as electronics grow more advanced.

The compound handling sector also shapes filled fluoropolymer markets. These materials are good for covering compound plant lines, valves, and holders because they resist synthetic chemicals. Filled fluoropolymers are in demand due to compound handling applications' need for strong, durable materials and strict health and environmental regulations. Ventures in emerging nations, where rapid industry and framework development increase material use, also impact market factors.

The filled fluoropolymer industry is shifting toward product improvements and advancements. Innovative designs with improved wear resistance, electrical conductivity, and warmth are being developed by manufacturers. These changes address end-user needs and provide new commercial avenues. With an emphasis on eco-friendly materials and production techniques, maintainability has become a convergence point. This trend aligns with global economic growth and encourages manufacturers to produce filled fluoropolymers with lower environmental impact.

Regardless, filled fluoropolymer markets have obstacles. These top presentation materials are expensive, which limits their reach, especially in cost-sensitive projects. Makers are simplifying production and exploring smart solutions to this test. Administrative elements and consistency requirements affect market components since companies must follow strict material use restrictions.

Leave a Comment