Focus on Enhancing Customer Satisfaction

A pronounced focus on enhancing customer satisfaction is becoming a critical driver in the Field Force Automation Market. Companies are recognizing that efficient field operations directly correlate with improved customer experiences. By automating field processes, organizations can ensure timely service delivery and effective communication with clients. Research indicates that businesses that prioritize customer satisfaction through automation can see a 20% increase in customer retention rates. This growing awareness is leading to increased investments in field force automation solutions that not only streamline operations but also enhance the overall customer journey, thereby fostering loyalty and long-term relationships.

Rising Demand for Operational Efficiency

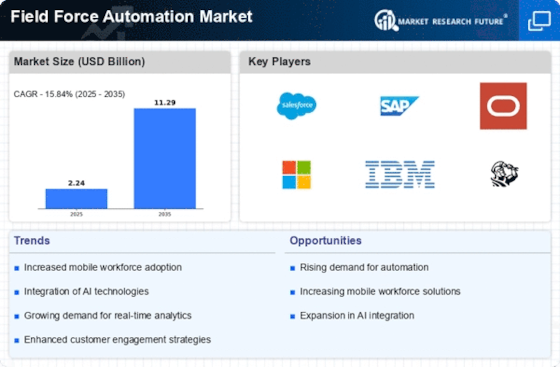

The Field Force Automation Market is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their field operations to enhance productivity and reduce costs. This trend is driven by the growing pressure to optimize resource allocation and improve service delivery. According to recent data, companies that implement field force automation solutions can achieve up to a 30% increase in operational efficiency. This heightened focus on efficiency is compelling businesses to invest in automation technologies that facilitate real-time data access and task management, thereby transforming traditional field operations into agile, responsive systems.

Growing Emphasis on Data-Driven Decision Making

The growing emphasis on data-driven decision making is reshaping the Field Force Automation Market. Organizations are increasingly leveraging data analytics to gain insights into field operations, customer preferences, and market trends. This shift towards data-centric strategies is prompting businesses to adopt field force automation solutions that provide robust analytics capabilities. Recent findings suggest that companies utilizing data analytics in their field operations can improve decision-making speed by up to 40%. As the importance of data continues to rise, the demand for automation tools that facilitate data collection and analysis is likely to increase, driving innovation in the market.

Technological Advancements in Mobile Applications

Technological advancements in mobile applications are significantly influencing the Field Force Automation Market. The proliferation of smartphones and tablets has enabled field workers to access critical information and tools on-the-go, thereby enhancing their productivity. Recent statistics indicate that mobile solutions can reduce the time spent on administrative tasks by approximately 25%. As organizations seek to empower their field teams with real-time data and communication capabilities, the demand for sophisticated mobile applications is expected to rise. This trend not only improves operational workflows but also fosters better customer engagement, as field agents can respond to inquiries and issues more promptly.

Integration of Internet of Things (IoT) Technologies

The integration of Internet of Things (IoT) technologies is emerging as a pivotal driver in the Field Force Automation Market. IoT devices facilitate seamless communication between field personnel and central management systems, enabling real-time monitoring and data collection. This connectivity allows organizations to make informed decisions based on accurate, up-to-date information. The market for IoT in field force automation is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. By leveraging IoT technologies, businesses can enhance their operational capabilities, improve asset management, and optimize service delivery.