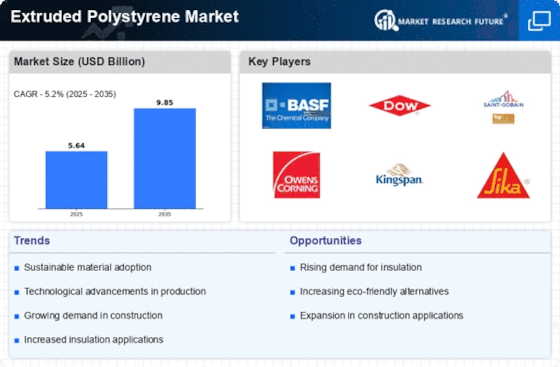

Rising Construction Activities

The increasing construction activities across various sectors, including residential, commercial, and industrial, appear to be a primary driver for the Extruded Polystyrene Market. As urbanization accelerates, the demand for effective insulation materials has surged. Extruded polystyrene, known for its excellent thermal insulation properties, is increasingly utilized in building applications. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to bolster the demand for extruded polystyrene, as builders seek materials that enhance energy efficiency and reduce overall costs. Furthermore, the trend towards sustainable building practices may further elevate the role of extruded polystyrene in modern construction projects.

Increased Awareness of Energy Efficiency

The heightened awareness regarding energy efficiency and its impact on environmental sustainability is driving the Extruded Polystyrene Market. As consumers and businesses alike become more conscious of their energy consumption, the demand for insulation materials that minimize heat loss has intensified. Extruded polystyrene is recognized for its superior insulation capabilities, which can lead to significant energy savings in both residential and commercial buildings. Market data indicates that energy-efficient buildings can reduce energy costs by up to 30%, making extruded polystyrene an attractive option for builders and architects. This growing emphasis on energy efficiency is likely to propel the market forward, as stakeholders seek to comply with increasingly stringent energy regulations and standards.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of extruded polystyrene are contributing to the growth of the Extruded Polystyrene Market. Innovations such as improved extrusion techniques and the development of new formulations are enhancing the performance characteristics of extruded polystyrene. These advancements not only improve the material's thermal insulation properties but also increase its durability and resistance to moisture. As manufacturers adopt these technologies, they are likely to produce higher quality products that meet the evolving needs of the construction industry. Furthermore, the integration of automation and smart manufacturing practices may lead to cost reductions and increased production efficiency, thereby expanding the market reach of extruded polystyrene.

Growing Demand in Cold Storage Applications

The rising demand for cold storage facilities is emerging as a significant driver for the Extruded Polystyrene Market. With the expansion of the food and pharmaceutical sectors, the need for effective insulation in cold storage applications has become paramount. Extruded polystyrene is favored for its excellent thermal resistance and moisture control, making it ideal for maintaining temperature-sensitive environments. Market analysis suggests that the cold storage industry is expected to grow at a robust rate, driven by the increasing need for efficient supply chain solutions. This trend is likely to create new opportunities for extruded polystyrene manufacturers, as they cater to the specific insulation needs of cold storage facilities.

Regulatory Support for Sustainable Materials

The regulatory landscape increasingly favors sustainable building materials, which is positively influencing the Extruded Polystyrene Market. Governments and regulatory bodies are implementing policies that promote the use of eco-friendly insulation materials to reduce carbon footprints. This regulatory support is likely to enhance the market for extruded polystyrene, as it is often viewed as a more sustainable option compared to traditional insulation materials. For instance, initiatives aimed at reducing greenhouse gas emissions are encouraging builders to adopt materials that contribute to energy efficiency. As a result, extruded polystyrene is positioned to benefit from these regulatory trends, potentially leading to increased market penetration and acceptance among construction professionals.