Construction Sector Growth

The construction sector is experiencing robust growth, which is likely to bolster the Aluminum Extruded Products Market. With urbanization and infrastructure projects on the rise, the demand for aluminum extrusions in building applications is increasing. In 2025, the construction industry is projected to account for nearly 40% of the total aluminum consumption, driven by the need for durable and lightweight materials. Aluminum extrusions are favored for their versatility, allowing for various applications such as window frames, roofing, and structural components. This trend suggests a sustained demand for aluminum extruded products, as construction projects continue to expand.

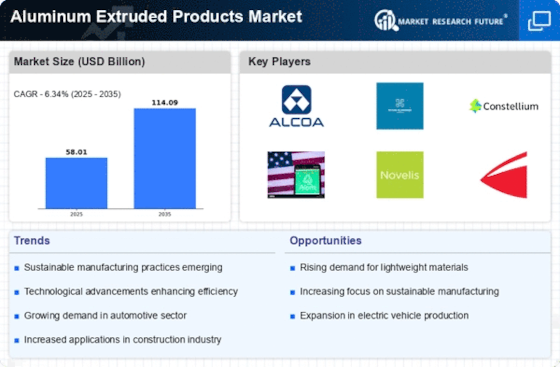

Rising Demand in Automotive Sector

The automotive sector appears to be a significant driver for the Aluminum Extruded Products Market. With the increasing focus on lightweight materials to enhance fuel efficiency and reduce emissions, manufacturers are increasingly adopting aluminum extrusions in vehicle design. In 2025, it is estimated that the use of aluminum in vehicles could reach approximately 30 million metric tons, reflecting a growing trend towards sustainable automotive solutions. This shift not only supports environmental goals but also aligns with consumer preferences for energy-efficient vehicles. As automakers continue to innovate, the demand for aluminum extruded products is likely to rise, further propelling the market forward.

Increased Focus on Lightweight Materials

The emphasis on lightweight materials across various industries is a crucial driver for the Aluminum Extruded Products Market. As companies strive to improve energy efficiency and reduce operational costs, aluminum extrusions are becoming the material of choice due to their strength-to-weight ratio. In 2025, it is estimated that the demand for lightweight materials in sectors such as aerospace and transportation could increase by 20%. This trend indicates a growing recognition of the benefits of aluminum extrusions, which not only enhance performance but also contribute to sustainability efforts.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are poised to enhance the Aluminum Extruded Products Market. Innovations such as 3D printing and advanced extrusion techniques are enabling manufacturers to produce more complex and customized aluminum profiles. These technologies not only improve efficiency but also reduce waste, aligning with sustainability goals. In 2025, it is anticipated that the adoption of these technologies could increase production capacity by up to 25%, allowing companies to meet the growing demand for specialized aluminum extrusions. This evolution in manufacturing is likely to create new opportunities within the market.

Growing Demand for Renewable Energy Solutions

The shift towards renewable energy sources is likely to drive the Aluminum Extruded Products Market. Aluminum extrusions are increasingly utilized in solar panel frames and wind turbine components, as they offer lightweight and corrosion-resistant properties. In 2025, the renewable energy sector is expected to require a substantial amount of aluminum, with projections indicating a growth rate of 15% annually. This trend reflects a broader commitment to sustainable energy solutions, which could further enhance the demand for aluminum extruded products as industries seek to reduce their carbon footprint.