Growing Environmental Awareness

The rising awareness of environmental issues is a significant driver for the EV Charging Cable Market. As consumers become more conscious of their carbon footprint, the shift towards electric vehicles is accelerating. This trend is supported by a growing body of research indicating that electric vehicles produce fewer emissions compared to traditional combustion engines. In 2025, it is expected that the market for electric vehicles will continue to expand, driven by consumer demand for sustainable transportation options. Consequently, the need for efficient charging solutions, including high-quality charging cables, will increase. The EV Charging Cable Market must align its offerings with this growing environmental consciousness to attract eco-minded consumers.

Rising Electric Vehicle Adoption

The increasing adoption of electric vehicles (EVs) is a primary driver for the EV Charging Cable Market. As consumers and businesses alike transition to electric mobility, the demand for compatible charging solutions surges. In 2025, it is estimated that the number of electric vehicles on the road will exceed 30 million, creating a substantial need for efficient charging infrastructure. This trend is further supported by various government initiatives aimed at promoting EV usage, which in turn drives the demand for EV charging cables. The EV Charging Cable Market must adapt to this growing consumer base, ensuring that the necessary charging solutions are available to meet the rising expectations of EV owners.

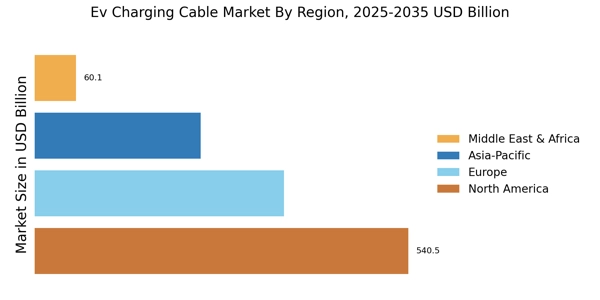

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a vital driver for the EV Charging Cable Market. As more charging stations are established in urban and rural areas, the accessibility of charging solutions improves, encouraging more consumers to adopt electric vehicles. By 2025, the number of public charging stations is projected to double, significantly impacting the demand for charging cables. This expansion is often supported by partnerships between private companies and government entities, which aim to create a comprehensive charging network. The EV Charging Cable Market must respond to this infrastructure growth by providing a diverse range of charging cables that cater to various charging station types and consumer needs.

Government Regulations and Incentives

Government regulations and incentives play a crucial role in shaping the EV Charging Cable Market. Many countries are implementing stringent emissions regulations, which encourage the adoption of electric vehicles and, consequently, the need for charging infrastructure. Financial incentives, such as tax credits and rebates for EV purchases, further stimulate market growth. In 2025, it is anticipated that regulatory frameworks will become even more supportive, with increased funding for charging infrastructure projects. This regulatory environment not only fosters consumer confidence in electric vehicles but also drives the demand for reliable and efficient charging cables. The EV Charging Cable Market must navigate these regulations to capitalize on the opportunities they present.

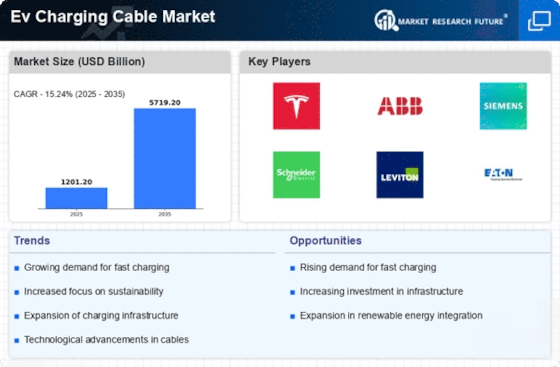

Technological Innovations in Charging Infrastructure

Technological advancements in charging infrastructure are significantly influencing the EV Charging Cable Market. Innovations such as ultra-fast charging capabilities and smart charging solutions are becoming increasingly prevalent. These advancements not only enhance the user experience but also improve the efficiency of charging processes. For instance, the introduction of high-capacity cables that can support rapid charging is expected to boost market growth. By 2025, the market for fast charging stations is projected to reach USD 10 billion, indicating a robust demand for advanced charging cables. The EV Charging Cable Market must keep pace with these technological developments to remain competitive and meet evolving consumer needs.