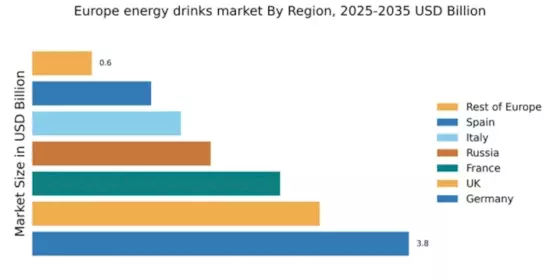

Germany : Strong Demand and Diverse Offerings

Germany holds a commanding 3.8% market share in the European energy drinks sector. This is driven by a robust consumer base and increasing health consciousness. Key growth drivers include a rising trend towards functional beverages and the popularity of energy drinks among young adults. Regulatory policies favoring product innovation and health standards have also contributed to market expansion. The country's advanced infrastructure supports efficient distribution and retail channels, enhancing accessibility for consumers.

UK : Health Trends Fueling Growth

The UK energy drinks market accounts for 2.9% of the European total, with a strong focus on health-oriented products. The increasing demand for low-sugar and organic options is reshaping consumption patterns. Government initiatives promoting healthier lifestyles have influenced consumer choices, while the vibrant nightlife in cities like London and Manchester drives sales. The competitive landscape features major players like Red Bull and Monster, alongside emerging local brands.

France : Cultural Influences on Consumption

France's energy drink market represents 2.5% of the European share, characterized by a preference for premium products. The growth is fueled by a shift towards natural ingredients and functional benefits. Regulatory frameworks emphasize labeling transparency, impacting consumer trust and choices. Cities like Paris and Lyon are key markets, where major players like Coca-Cola and local brands compete. The market is also influenced by the sports and fitness culture prevalent in urban areas.

Russia : Youth-Driven Consumption Trends

Russia holds a 1.8% share in the energy drinks market, with significant growth potential driven by a young population. The demand for energy drinks is rising, particularly among students and young professionals. Regulatory policies are gradually evolving to accommodate market growth, while urbanization enhances distribution networks. Key cities like Moscow and St. Petersburg are central to market dynamics, with major players like Red Bull and local brands vying for market share.

Italy : Growing Acceptance Among Consumers

Italy's energy drink market accounts for 1.5% of the European total, with increasing acceptance among consumers. The growth is driven by changing lifestyles and a rising interest in fitness. Regulatory policies are becoming more supportive, promoting product safety and quality. Key markets include Milan and Rome, where major players like Monster and local brands are establishing a foothold. The competitive landscape is evolving, with a focus on innovative flavors and health-oriented products.

Spain : Youth Culture Drives Demand

Spain's energy drink market represents 1.2% of the European share, characterized by a vibrant youth culture. The demand is driven by social activities and nightlife, particularly in cities like Barcelona and Madrid. Regulatory frameworks are adapting to market needs, ensuring product safety and quality. Major players like Red Bull and PepsiCo dominate the landscape, while local brands are gaining traction. The market is also influenced by sports sponsorships and events.

Rest of Europe : Diverse Preferences Across Regions

The Rest of Europe accounts for 0.6% of the energy drinks market, showcasing a fragmented landscape with diverse consumer preferences. Growth is driven by niche brands catering to local tastes and health trends. Regulatory policies vary significantly across countries, impacting market entry and competition. Key markets include smaller urban centers where local brands thrive. The competitive environment is characterized by a mix of international giants and regional players, each adapting to local demands.