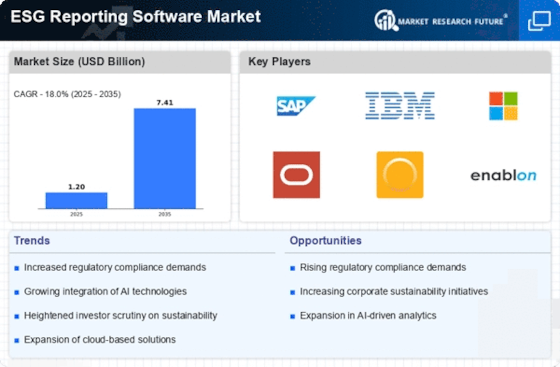

The ESG Reporting Software Market is currently experiencing a notable transformation, driven by an increasing emphasis on sustainability and corporate responsibility. Organizations across various sectors are recognizing the necessity of transparent reporting practices that align with environmental, social, and governance criteria. This shift appears to be influenced by heightened regulatory scrutiny and stakeholder expectations, compelling companies to adopt robust reporting frameworks. The global ESG reporting software market is expanding rapidly as organizations prioritize transparency, regulatory compliance, and sustainability performance.

The adoption of corporate sustainability reporting software is accelerating as enterprises seek standardized frameworks for environmental, social, and governance disclosures. The demand for software for sustainability reporting is rising as regulatory pressures and investor expectations continue to intensify. Advanced sustainability ESG reporting software enables organizations to integrate environmental, social, and governance data into a unified reporting framework. As a result, the demand for sophisticated software solutions that facilitate accurate data collection, analysis, and reporting is on the rise. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning into ESG reporting tools is enhancing their capabilities, allowing for more nuanced insights and predictive analytics. In addition to technological advancements, the ESG Reporting Software Market is witnessing a growing trend towards standardization of reporting frameworks.

The use of ESG monitoring software is increasing as organizations track emissions, governance risks, and social impact metrics in real time. Automated ESG tracking software improves data accuracy and enhances regulatory compliance across reporting cycles. Each ESG reporting tool enables organizations to standardize disclosures and improve audit readiness. An integrated sustainability reporting solution simplifies compliance with global ESG disclosure standards. Organizations are increasingly adopting sustainability reporting solutions to improve transparency and investor confidence. Various international guidelines and frameworks are emerging, which may help organizations streamline their reporting processes and ensure compliance with global standards. This trend suggests a potential shift towards a more unified approach to ESG reporting, which could simplify the landscape for businesses.

Overall, the ESG Reporting Software Market is poised for continued growth as organizations strive to meet evolving expectations and leverage technology to enhance their sustainability initiatives. Efficient ESG data collection is becoming critical as organizations manage increasing volumes of sustainability-related metrics. Modern ESG data collection software automates the capture of environmental, social, and governance indicators across business units. An integrated ESG data management platform allows enterprises to centralize sustainability metrics and ensure reporting accuracy. The adoption of ESG data management software is increasing as companies seek real-time visibility into sustainability performance.

Technological Integration

The incorporation of advanced technologies such as artificial intelligence and machine learning into ESG reporting tools is becoming increasingly prevalent. These innovations enable organizations to analyze vast amounts of data more efficiently, providing deeper insights into their sustainability practices.

A scalable ESG reporting platform enables organizations to streamline compliance and stakeholder disclosures. Cloud-based ESG reporting platforms are gaining traction due to flexibility, real-time updates, and regulatory alignment. Enterprises increasingly rely on a centralized sustainability reporting platform to manage regulatory and voluntary disclosures. The adoption of cloud-based sustainability reporting platforms is expanding across regulated industries worldwide. Advanced ESG analysis tools provide predictive insights that support strategic sustainability decision-making.

Standardization of Reporting Frameworks

There is a noticeable movement towards the standardization of ESG reporting frameworks. This trend may facilitate a more cohesive approach to reporting, allowing companies to align their practices with international guidelines and enhance comparability across sectors.

A cloud-based sustainability reporting tool supports SMEs in meeting emerging ESG compliance requirements. Digital sustainability reporting tools are becoming essential for managing large volumes of ESG data efficiently. The Environmental segment is driven by growing adoption of environmental reporting software for emissions tracking and regulatory compliance. The market for software sustainability reporting is expanding as enterprises formalize ESG disclosure processes.

Increased Regulatory Scrutiny

The ESG Reporting Software Market is influenced by growing regulatory scrutiny regarding sustainability practices. Governments and regulatory bodies are implementing stricter requirements, prompting organizations to adopt comprehensive reporting solutions to ensure compliance.