Increased Regulatory Requirements

Increased regulatory requirements surrounding ESG disclosures are driving the ESG Investment Analytics Market. Governments and regulatory bodies are implementing stricter guidelines that mandate companies to report on their ESG performance. For example, the European Union's Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to disclose how they integrate ESG risks into their investment decisions. This regulatory landscape compels companies to adopt comprehensive ESG analytics frameworks to ensure compliance and avoid potential penalties. As a result, the demand for ESG analytics solutions is expected to rise, as firms seek to navigate the complexities of regulatory compliance while enhancing their ESG reporting capabilities. The ESG Investment Analytics Market is thus positioned for growth as organizations strive to meet these evolving regulatory standards.

Rising Awareness of Sustainability

The increasing awareness of sustainability among investors and consumers is a pivotal driver for the ESG Investment Analytics Market. As stakeholders become more conscious of environmental and social issues, they are demanding greater transparency from companies regarding their ESG practices. This heightened awareness is reflected in the growing number of investment funds that prioritize ESG criteria, with assets under management in sustainable funds reaching approximately 35 trillion USD in recent years. Consequently, firms are compelled to adopt robust ESG analytics to meet investor expectations and enhance their reputational standing. The ESG Investment Analytics Market is thus witnessing a surge in demand for tools that can effectively measure and report on sustainability metrics, enabling investors to make informed decisions that align with their values.

Consumer Demand for Ethical Practices

Consumer demand for ethical practices is emerging as a crucial driver for the ESG Investment Analytics Market. As consumers increasingly prefer brands that demonstrate a commitment to sustainability and social responsibility, companies are compelled to adopt ESG principles to maintain their market position. This shift in consumer behavior is reflected in the rise of ethical consumerism, with studies indicating that a significant percentage of consumers are willing to pay a premium for products from socially responsible companies. In response, businesses are investing in ESG analytics to better understand consumer preferences and enhance their sustainability initiatives. The ESG Investment Analytics Market is thus witnessing a surge in demand for tools that can analyze consumer sentiment and behavior, allowing companies to tailor their strategies to meet the expectations of socially conscious consumers.

Growing Institutional Investment in ESG

The growing trend of institutional investment in ESG assets is a significant driver for the ESG Investment Analytics Market. Institutional investors, such as pension funds and insurance companies, are increasingly allocating capital to ESG-focused investments, recognizing the long-term financial benefits associated with sustainable practices. Reports indicate that institutional assets under management in ESG strategies have surpassed 20 trillion USD, highlighting a shift in investment philosophy. This trend is likely to continue as institutions seek to mitigate risks associated with climate change and social issues. Consequently, the ESG Investment Analytics Market is experiencing heightened demand for analytics tools that can provide insights into the performance and impact of ESG investments, enabling institutions to align their portfolios with sustainability goals.

Technological Advancements in Data Analytics

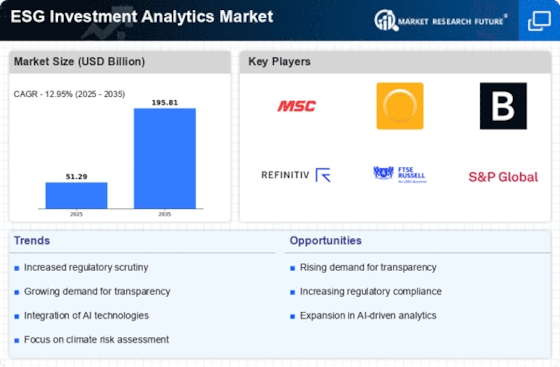

Technological advancements in data analytics are significantly influencing the ESG Investment Analytics Market. The integration of artificial intelligence, machine learning, and big data analytics allows for more sophisticated analysis of ESG factors. These technologies enable investors to process vast amounts of data, uncovering insights that were previously unattainable. For instance, the market for AI-driven analytics tools is projected to grow at a compound annual growth rate of over 25% in the coming years. This trend suggests that firms leveraging advanced analytics will have a competitive edge in identifying ESG risks and opportunities. As a result, the ESG Investment Analytics Market is evolving rapidly, with a focus on developing innovative solutions that enhance data accuracy and predictive capabilities.