Rise of Investor Activism

Investor activism is becoming a prominent force within the ESG Software Market. Shareholders are increasingly demanding that companies prioritize sustainable practices and disclose their ESG performance. This shift is evidenced by a significant increase in shareholder proposals related to ESG issues, with a reported rise of over 30% in such proposals in recent years. As investors seek to hold companies accountable, the demand for ESG software solutions that facilitate effective communication and reporting is likely to expand. This trend not only influences corporate behavior but also propels the growth of the ESG Software Market as firms strive to align with investor expectations.

Corporate Social Responsibility Initiatives

The emphasis on corporate social responsibility (CSR) is a key driver within the ESG Software Market. Companies are increasingly adopting CSR initiatives as part of their strategic objectives, recognizing the importance of social and environmental stewardship. This shift is reflected in the growing number of organizations that are implementing ESG software to manage and report on their CSR activities. Research indicates that companies with robust CSR programs tend to outperform their peers in terms of financial performance. Consequently, the ESG Software Market is likely to benefit from this trend as more firms seek to enhance their CSR efforts through effective software solutions.

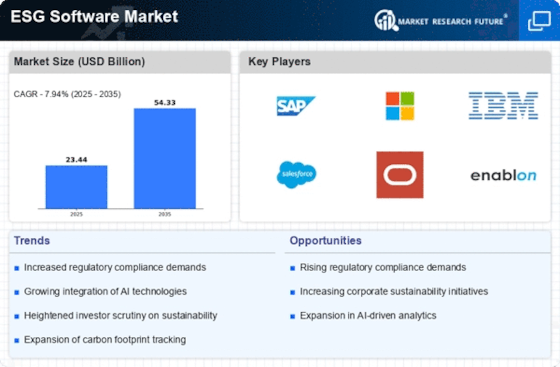

Growing Demand for Sustainability Reporting

The ESG Software Market is experiencing a notable surge in demand for sustainability reporting solutions. Companies are increasingly recognizing the necessity of transparent reporting on environmental, social, and governance metrics. This trend is driven by heightened awareness among consumers and investors regarding corporate responsibility. According to recent data, approximately 70% of investors now consider ESG factors in their investment decisions. As a result, organizations are compelled to adopt ESG software to streamline their reporting processes and enhance their credibility. The ESG Software Market is thus positioned to grow as firms seek to meet these evolving expectations and regulatory requirements.

Technological Advancements in Data Analytics

The integration of advanced data analytics technologies is transforming the ESG Software Market. Companies are leveraging big data and artificial intelligence to enhance their ESG performance tracking and reporting capabilities. These technologies enable organizations to analyze vast amounts of data efficiently, providing insights that were previously unattainable. As a result, firms can make informed decisions that align with their sustainability goals. The market for ESG software is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is indicative of the increasing reliance on technology to drive ESG initiatives.

Regulatory Pressures and Compliance Requirements

Regulatory pressures are intensifying within the ESG Software Market, compelling organizations to adopt comprehensive ESG strategies. Governments and regulatory bodies are increasingly mandating disclosures related to ESG performance, creating a pressing need for effective software solutions. Recent legislative developments indicate that compliance requirements are becoming more stringent, with penalties for non-compliance on the rise. This environment is driving companies to invest in ESG software to ensure adherence to regulations and mitigate risks associated with non-compliance. As a result, the ESG Software Market is poised for growth as organizations prioritize compliance and transparency in their operations.