Rising Demand for Content Production

The Entertainment Insurance Market is experiencing a notable increase in demand for content production, driven by the proliferation of streaming platforms and digital media. As more companies invest in original content, the need for comprehensive insurance coverage becomes paramount. This trend is evidenced by the fact that The Entertainment Insurance Market is projected to reach approximately 100 billion USD by 2025. Consequently, production companies are seeking tailored insurance solutions to mitigate risks associated with filming, including equipment damage, liability, and cast injuries. This rising demand for content production is likely to propel the growth of the Entertainment Insurance Market, as stakeholders recognize the necessity of safeguarding their investments against unforeseen events.

Expansion of Live Events and Festivals

The Entertainment Insurance Market is significantly influenced by the expansion of live events and festivals, which have become increasingly popular in recent years. This trend is underscored by the fact that the global live event industry is expected to surpass 1 trillion USD by 2025. As event organizers seek to protect their financial interests, the demand for specialized insurance products tailored to live performances, concerts, and festivals is on the rise. Coverage for event cancellation, liability, and property damage is becoming essential for organizers to ensure the success of their events. This expansion in live events is likely to drive the growth of the Entertainment Insurance Market, as stakeholders prioritize risk management and financial security.

Increased Awareness of Risk Management

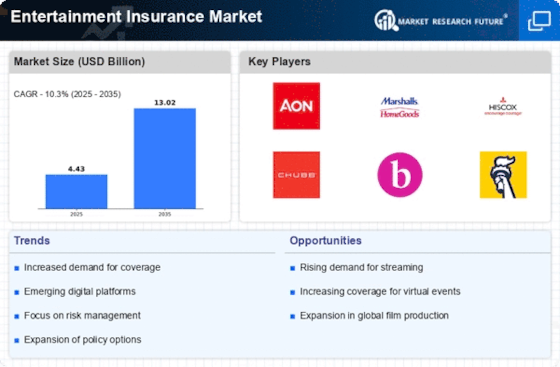

The Entertainment Insurance Market is witnessing a heightened awareness of risk management among industry stakeholders. As the entertainment landscape evolves, producers, directors, and event organizers are increasingly recognizing the importance of protecting their assets and investments. This shift is reflected in the growing adoption of comprehensive insurance policies that cover a wide range of risks, including production delays, equipment failure, and liability claims. The market for entertainment insurance is projected to grow at a compound annual growth rate of around 5% over the next few years, indicating a robust demand for risk management solutions. This increased awareness is likely to bolster the Entertainment Insurance Market, as stakeholders seek to navigate the complexities of modern entertainment production.

Regulatory Changes and Compliance Requirements

The Entertainment Insurance Market is influenced by ongoing regulatory changes and compliance requirements that necessitate robust insurance coverage. As governments and industry bodies implement stricter regulations regarding safety, liability, and environmental impact, entertainment companies are compelled to adapt their insurance strategies accordingly. This trend is particularly evident in regions where regulatory frameworks are evolving to address emerging risks associated with new technologies and production methods. Companies that fail to comply with these regulations may face significant financial penalties, underscoring the importance of comprehensive insurance coverage. As a result, the demand for specialized insurance products that meet regulatory standards is likely to drive growth in the Entertainment Insurance Market.

Technological Advancements in Insurance Solutions

The Entertainment Insurance Market is being transformed by technological advancements that enhance the efficiency and effectiveness of insurance solutions. Innovations such as artificial intelligence, data analytics, and blockchain technology are enabling insurers to offer more personalized and responsive coverage options. For instance, AI-driven risk assessment tools can provide real-time insights into potential hazards, allowing producers to make informed decisions regarding their insurance needs. As technology continues to evolve, the Entertainment Insurance Market is likely to benefit from improved underwriting processes and claims management, ultimately leading to a more streamlined experience for clients. This technological integration may also attract new entrants to the market, further stimulating growth.