North America : Market Leader in Innovation

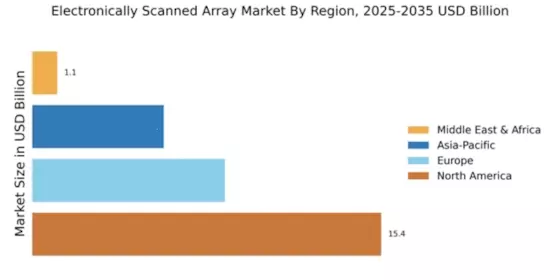

North America continues to lead the Electronically Scanned Array market, holding a significant share of 15.4 in 2024. The region's growth is driven by increasing defense budgets, technological advancements, and a strong focus on R&D. Regulatory support for defense initiatives and modernization programs further catalyze demand, ensuring a robust market environment. The integration of advanced technologies like AI and machine learning is also enhancing the capabilities of electronically scanned arrays, making them indispensable in modern warfare.

The competitive landscape in North America is characterized by the presence of major players such as Northrop Grumman, Raytheon Technologies, and Lockheed Martin. These companies are at the forefront of innovation, continuously developing cutting-edge solutions to meet the evolving needs of defense and aerospace sectors. The U.S. government’s commitment to enhancing military capabilities ensures a steady demand for electronically scanned arrays, solidifying the region's market leadership.

Europe : Emerging Market with Growth Potential

Europe's Electronically Scanned Array market is poised for growth, with a market size of 8.5 in 2024. The region is witnessing increased investments in defense and security, driven by geopolitical tensions and the need for advanced surveillance systems. Regulatory frameworks are evolving to support innovation and collaboration among member states, enhancing the market's attractiveness. The push for modernization of military assets is also a significant driver, as countries seek to upgrade their defense capabilities with state-of-the-art technologies.

Leading countries in Europe include France, Germany, and the UK, where key players like Thales Group and BAE Systems are actively involved in developing advanced electronically scanned arrays. The competitive landscape is marked by strategic partnerships and collaborations aimed at enhancing technological capabilities. As European nations prioritize defense spending, the demand for electronically scanned arrays is expected to rise, positioning the region as a significant player in the global market.

Asia-Pacific : Rapidly Growing Defense Sector

The Asia-Pacific region is experiencing a surge in the Electronically Scanned Array market, with a market size of 5.8 in 2024. This growth is fueled by increasing defense expenditures, modernization efforts, and the rising need for advanced surveillance and reconnaissance systems. Countries in the region are investing heavily in military capabilities, driven by regional security concerns and technological advancements. Regulatory support for defense initiatives is also playing a crucial role in fostering market growth, as nations seek to enhance their defense readiness.

Key players in the Asia-Pacific market include major defense contractors and local manufacturers, with countries like China, India, and Japan leading the charge. The competitive landscape is dynamic, with companies focusing on innovation and strategic partnerships to capture market share. As the region continues to prioritize defense spending, the demand for electronically scanned arrays is expected to grow significantly, making it a vital market in the global landscape.

Middle East and Africa : Emerging Market with Strategic Importance

The Middle East and Africa region is emerging as a strategic market for Electronically Scanned Arrays, with a market size of 1.1 in 2024. The growth in this region is driven by increasing defense budgets, geopolitical tensions, and the need for advanced military technologies. Countries are focusing on enhancing their defense capabilities, leading to a rise in demand for sophisticated surveillance and reconnaissance systems. Regulatory frameworks are gradually evolving to support these initiatives, fostering a conducive environment for market growth.

Leading countries in the region include the UAE, Saudi Arabia, and South Africa, where key players are beginning to establish a presence. The competitive landscape is characterized by partnerships between local and international firms, aimed at leveraging technological advancements. As the region continues to invest in defense, the demand for electronically scanned arrays is expected to increase, highlighting its strategic importance in the global market.