Expansion of IoT Applications

The proliferation of Internet of Things (IoT) devices is a key driver for the field programmable-gate-array market. As IoT applications become more sophisticated, the need for flexible and reconfigurable hardware solutions is increasing. FPGAs offer the adaptability required to support various protocols and standards, making them ideal for IoT deployments. In 2025, the market for FPGAs in IoT applications is projected to grow by approximately 15%, reflecting the increasing reliance on these devices for smart home, industrial automation, and healthcare solutions. This expansion underscores the critical role of field programmable-gate-array technology in the evolving landscape of IoT.

Increased Adoption in Data Centers

The growing demand for data processing and storage capabilities is propelling the field programmable-gate-array market, particularly within data centers. FPGAs are increasingly utilized for their ability to accelerate workloads and enhance performance in cloud computing environments. As organizations seek to optimize their infrastructure, the integration of FPGAs is becoming more prevalent. In 2025, it is estimated that the contribution of FPGAs to data center applications will account for nearly 25% of the total market share. This trend indicates a significant shift towards utilizing field programmable-gate-array technology to meet the escalating demands of data-intensive applications.

Technological Advancements in FPGA Design

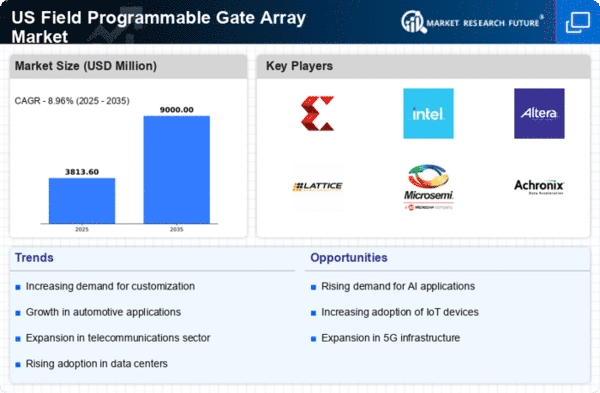

The field programmable-gate-array market is experiencing a surge due to rapid technological advancements in FPGA design methodologies. Innovations such as high-level synthesis (HLS) and improved design tools are enabling engineers to create more complex and efficient designs. This evolution is likely to enhance the performance and reduce the time-to-market for various applications. In 2025, the market is projected to reach approximately $8 billion, reflecting a compound annual growth rate (CAGR) of around 10% from previous years. These advancements not only streamline the design process but also expand the potential applications of FPGAs across industries, thereby driving growth in the field programmable-gate-array market.

Growing Focus on Customization in Electronics

Customization in electronic devices is becoming increasingly important, driving demand in the field programmable-gate-array market. Manufacturers are seeking solutions that allow for tailored functionalities to meet specific application requirements. FPGAs provide the flexibility to implement custom logic and processing capabilities, which is particularly valuable in sectors such as aerospace, defense, and consumer electronics. The customization trend is expected to contribute to a market growth rate of around 12% in 2025, as companies leverage field programmable-gate-array technology to differentiate their products and enhance performance.

Rising Investment in Research and Development

Investment in research and development (R&D) within the semiconductor industry is significantly impacting the field programmable-gate-array market. Companies are allocating substantial resources to innovate and improve FPGA technologies, which is likely to lead to enhanced performance, lower power consumption, and increased integration capabilities. In 2025, R&D spending in this sector is projected to exceed $1 billion, reflecting a commitment to advancing field programmable-gate-array solutions. This focus on innovation is expected to drive competitive advantages and foster growth in the market, as new applications and functionalities emerge.