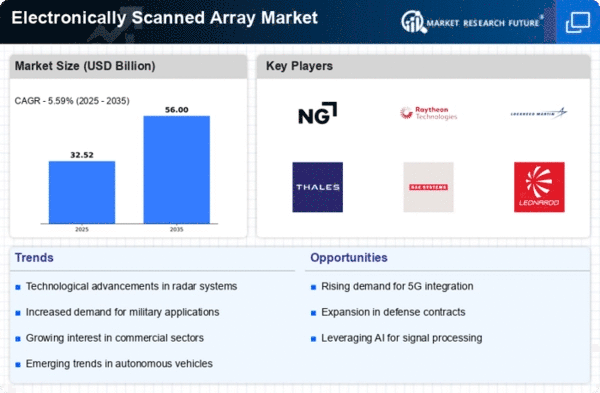

Top Industry Leaders in the Electronically Scanned Array Market

Key Players

Lockheed Martin (US)

Northrop Grumman (US)

Leonardo-Finmeccanica (Italy)

Raytheon (US)

Saab AB (Sweden)

Israel Aerospace Industries (Israel)

Thales Group (France)

Toshiba (Japan)

RADA Electronic Industries (Israel)

Defence Research and Development Organization (India)

Strategies Adopted To maintain a competitive edge, key players in the ESA market employ diverse strategies that align with the evolving needs of their clients. Technological innovation is a cornerstone, with companies investing heavily in research and development to enhance the performance and capabilities of their ESA systems. Lockheed Martin, for instance, has focused on developing advanced AESA (Active Electronically Scanned Array) radar technology, ensuring superior target detection and tracking.

Global partnerships and collaborations are another prominent strategy, facilitating knowledge exchange and leveraging complementary strengths. Joint ventures allow companies to pool resources, share expertise, and tackle complex projects more efficiently. Raytheon Technologies' collaborations with international defense contractors exemplify this strategy, enabling the company to participate in global defense programs and expand its market reach.

Factors for Market Share Analysis Several factors contribute to the analysis of market share within the ESA industry. Technological expertise and the ability to offer cutting-edge solutions play a crucial role in establishing a company's market dominance. The versatility of radar systems, whether applied to airborne, naval, or ground-based platforms, is another determining factor. Companies that provide comprehensive solutions across multiple domains tend to capture a larger market share.

Customer trust and satisfaction are paramount in the defense and aerospace sectors, influencing procurement decisions. Timely delivery, reliability, and post-sales support are critical aspects that impact market share. Additionally, regulatory compliance and adherence to industry standards ensure that a company's products meet the stringent requirements of defense and aerospace applications, further solidifying its position in the market.

New and Emerging Companies While established players dominate the ESA market, new and emerging companies are making noteworthy contributions, introducing fresh perspectives and innovative solutions. Smaller firms like Leonardo S.p.A and Saab AB have gained recognition for their agility and specialization in specific ESA applications. These companies often focus on niche markets or disruptive technologies, challenging established norms and bringing diversity to the competitive landscape.

Start-ups such as RADA Electronic Industries are capitalizing on the demand for compact and cost-effective radar solutions. These emerging players introduce competition that fosters innovation, as they strive to address evolving customer needs and carve a niche for themselves in the market.

Industry News Staying abreast of industry news is crucial in understanding the dynamics of the ESA market. Recent developments include the integration of artificial intelligence (AI) and machine learning algorithms into ESA systems, enhancing their capabilities for threat detection and tracking. The industry has also witnessed advancements in materials and manufacturing techniques, leading to lighter and more efficient ESA antennas.

Moreover, geopolitical events and international collaborations impact the ESA market. The formation of alliances and partnerships between countries for joint defense projects influences procurement decisions and market trends. Additionally, the ongoing digitalization of radar systems and the integration of ESA technology into unmanned platforms represent transformative shifts in the industry.

Current Company Investment Trends Investment trends within the ESA market underscore the industry's commitment to continuous improvement and innovation. Research and development remain a top priority, with companies allocating significant resources to explore emerging technologies, improve radar performance, and address evolving threats. Investments in AI, machine learning, and data analytics are prevalent, reflecting a strategic focus on enhancing the intelligence and adaptability of ESA systems.

Global expansion is another notable investment trend, with companies seeking to establish a stronger presence in emerging markets. Joint ventures and collaborations with local partners enable companies to navigate regulatory landscapes and address region-specific requirements effectively. Furthermore, investments in cybersecurity measures have become imperative, considering the increasing vulnerability of radar systems to cyber threats.

Overall Competitive Scenario In conclusion, the competitive landscape of the Electronically Scanned Array market mirrors the rapid evolution of radar technology. Key players, including Raytheon Technologies, Lockheed Martin, Northrop Grumman, and Thales Group, lead the charge with their technological prowess and global reach. Strategies such as technological innovation, global collaborations, and a focus on customer satisfaction contribute to their market dominance.

Factors influencing market share analysis encompass technological expertise, product versatility, customer trust, and regulatory compliance. While established players hold significant sway, new and emerging companies inject vitality into the market, introducing niche solutions and disruptive technologies. Industry news reflects ongoing advancements, geopolitical influences, and transformative shifts, while current investment trends underscore the commitment to innovation, global expansion, and cybersecurity.

As the ESA market continues to advance, companies that navigate these complexities, adapt to emerging trends, and prioritize technological excellence will stand at the forefront of this dynamic and pivotal industry.

Recent News

Raytheon Technologies (RTX)

Secured a multi-billion dollar contract to provide next-generation APG-859 ESAs for the F-35 fighter jets, boasting enhanced range, detection capabilities, and electronic countermeasures.

Partnered with the Australian Defence Force to develop and manufacture ESAs for their future Jindalee Operational Radar Network (JORN), expanding their global reach.

Lockheed Martin Corporation (LMT)

Successfully completed the first flight of the F-21 fighter jet equipped with the AN/APG-86 AESA radar, showcasing its potential for dominance in future air combat.

Awarded a contract to upgrade the ESAs on the U.S. Navy's Aegis combat system, ensuring continued effectiveness against evolving threats.

Thales Group (HO)

Unveiled the Ground Master 400 AESA radar for air and missile defense, featuring long-range detection and tracking capabilities alongside enhanced counter-stealth performance.

Partnered with Leonardo S.p.A. to develop a new European AESA radar for naval applications, aiming to strengthen European competitiveness in this critical sector.

Leonardo S.p.A. (FIN)

Developed the Kronos Grand Power AESA radar for naval vessels, offering multi-function capabilities for air and surface target detection and tracking.

Collaborating with MBDA to integrate ESAs into missile systems, improving targeting accuracy and resilience against electronic warfare.