Rising Fuel Prices

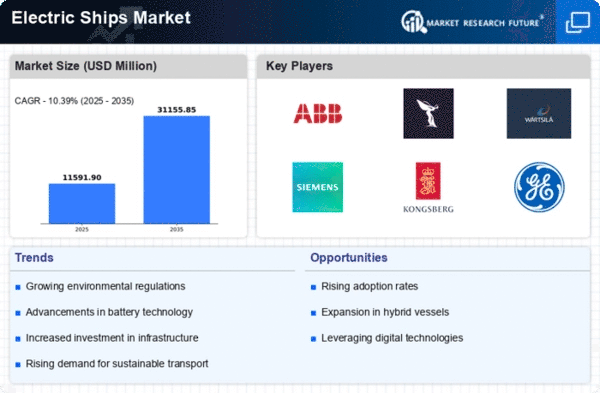

The Global Electric Ships Industry is also being propelled by the rising prices of traditional fuels. As fuel costs continue to escalate, shipping companies are seeking alternative solutions to mitigate operational expenses. Electric ships, which utilize electricity as a primary energy source, present a cost-effective alternative in the long term. This shift is particularly relevant in regions where fuel prices are volatile. The market is anticipated to expand significantly, with projections indicating a growth to 31.2 USD Billion by 2035, as more companies transition to electric vessels to enhance their economic sustainability.

Growing Environmental Regulations

The Global Electric Ships Industry is experiencing a surge in demand due to stringent environmental regulations aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that encourage the adoption of cleaner technologies in maritime transport. For instance, the International Maritime Organization has set ambitious targets for reducing emissions, which has prompted shipbuilders to invest in electric propulsion systems. This regulatory landscape is likely to drive the market's growth, as the Global Electric Ships Market is projected to reach 10.5 USD Billion in 2024, reflecting a growing commitment to sustainable practices in the shipping industry.

Technological Advancements in Battery Systems

Technological innovations in battery systems are significantly influencing the Global Electric Ships Industry. Advances in lithium-ion and solid-state batteries have enhanced energy density and reduced charging times, making electric ships more viable. These improvements not only increase the operational range of electric vessels but also lower operational costs. As a result, shipbuilders are increasingly integrating these advanced battery technologies into their designs. The Global Electric Ships Market is expected to grow at a CAGR of 10.39% from 2025 to 2035, indicating a robust trend towards electrification in maritime transport.

Growing Consumer Demand for Sustainable Shipping

Consumer preferences are shifting towards sustainability, which is influencing the Global Electric Ships Industry. As awareness of environmental issues increases, consumers are demanding more sustainable shipping options. This trend is prompting shipping companies to adopt electric vessels to meet customer expectations and enhance their brand image. Companies that invest in electric ships are likely to gain a competitive edge in the market. The growing consumer demand for eco-friendly shipping solutions is expected to contribute to the overall growth of the Global Electric Ships Market, aligning with broader sustainability goals.

Increasing Investment in Electric Infrastructure

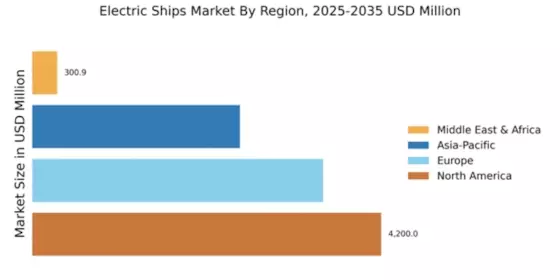

Investment in electric infrastructure is a critical driver for the Global Electric Ships Industry. Ports and shipping companies are increasingly investing in charging stations and related infrastructure to support the operation of electric vessels. This trend is evident in various regions, where governments are incentivizing the development of green ports. Enhanced infrastructure not only facilitates the adoption of electric ships but also improves the overall efficiency of maritime operations. As the Global Electric Ships Market continues to evolve, the establishment of robust charging networks will likely play a pivotal role in its expansion.