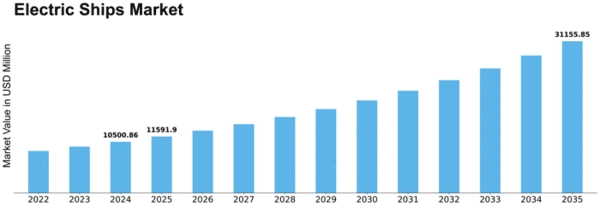

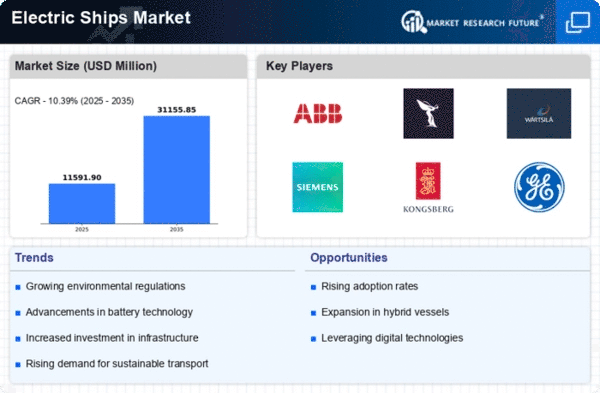

Electric Ships Size

Electric Ships Market Growth Projections and Opportunities

Two of the primary causes are the shift to energy from sustainable sources and the increasing focus on global sustainability. An increasing number of ships within the marine industry are using electric propulsion systems in an attempt to lower their carbon emissions. The aim to lessen negative environmental consequences, follow tight emission regulations, and improve the electrical effectiveness of maritime transport is what is driving this advancement.

The market for electric ships is largely shaped by economic factors as well. The instability associated with conventional fuel prices coupled with rising fuel costs has forced owners of ships and operators to look for more affordable options. Long-term, electric propulsion systems powered by batteries and fuel cells—two sustainable energy sources—offer a more dependable and potentially economical option. The increasing amount of government encouragement and rewards for the use of green methods, which draws investors throughout the marine sector, further supports the commercial feasibility of electrically propelled ships.

Technological advancements are a crucial factor driving the market for electric ships. The use of electric propulsion within maritime applications has become more practical and realistic due to developments in power management systems, electronic motor technology, and the creation of more energy-efficient batteries. It is anticipated that as these technologies develop and become more accessible, the number of electric ships is going to increase and the shipping sector will change.

Initiatives pertaining to regulations have a big impact on how the market for electric ships develops. Regulations aimed at lowering emissions of greenhouse gases and enhancing the sustainability of the environment in the maritime industry are being passed by governments and international bodies more frequently. Shipowners are being forced to investigate cleaner propulsion choices due to strict pollution standards and the identification of emission control areas. Electric propulsion is emerging as a crucial solution for meeting these regulatory requirements.

The electric ships market is being shaped by industry collaborations and market competition, which are encouraging innovation and hastening the deployment of electric propulsion technology. There is a competition underway among ship builders & maritime technology suppliers to create more economical and efficient electric vessels. Ship builders, technology companies, and energy providers are working together to make it easier to retrofit older boats using electrical power systems and include electrical propulsion systems in newly built ships.

Global factors that are impacting the market for electric ships include the growing emphasis on renewable energy sources and a movement toward decarbonization. Electric ships are primarily driving the shift to more environmentally friendly transportation, as the maritime industry's dedication to sustainability coincides with larger international initiatives to reduce climate change. Due to rising environmental awareness and the requirement for sustainable operations, the market is moving in favor of electrically operated ships as a more affordable and environmentally friendly replacement to traditional propulsion systems.

In conclusion, as the market for electric ships moves into a revolutionary phase, a number of factors including global industry trends, technological breakthroughs, economic factors, and governmental measures are pushing the market. As the marine industry strives to embrace more environmentally friendly and sustainable methods, electric ships may have a significant influence on future advances in maritime transportation.

Leave a Comment