Increased Urbanization

The trend of increased urbanization significantly impacts the Electric Motors Household Appliances Market. As urban populations grow, there is a corresponding rise in demand for household appliances that facilitate modern living. Urban dwellers often seek appliances that are not only efficient but also space-saving and multifunctional. This demand drives manufacturers to innovate and produce electric motors that cater to the specific needs of urban consumers. Furthermore, urbanization is often associated with higher disposable incomes, which may lead to increased spending on advanced household appliances. This trend is expected to bolster the market for electric motors in household appliances, as manufacturers strive to meet the evolving demands of urban consumers.

Rising Consumer Awareness

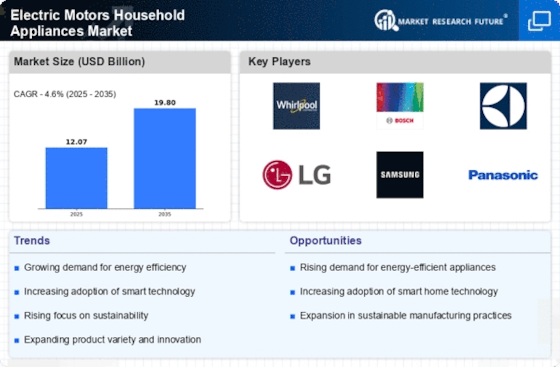

Consumer awareness regarding energy consumption and environmental impact is a pivotal driver in the Electric Motors Household Appliances Market. As individuals become more informed about the benefits of energy-efficient appliances, there is a noticeable shift in purchasing behavior. Reports indicate that a substantial percentage of consumers prioritize energy efficiency when selecting household appliances, which directly influences manufacturers to enhance their product offerings. This trend is likely to continue, as consumers increasingly seek appliances that not only perform well but also contribute to sustainability. Consequently, the demand for electric motors that power these appliances is expected to rise, further shaping the market dynamics.

Technological Advancements

Technological advancements play a crucial role in shaping the Electric Motors Household Appliances Market. Innovations in electric motor design and manufacturing processes have led to the development of more compact, efficient, and durable motors. For example, the introduction of brushless DC motors has revolutionized the performance of household appliances, providing higher efficiency and lower noise levels. Additionally, advancements in materials science have enabled the production of lighter and more robust components, enhancing the overall functionality of electric motors. As these technologies continue to evolve, they are likely to drive the market forward, creating new opportunities for manufacturers and consumers alike.

Energy Efficiency Regulations

The Electric Motors Household Appliances Market is increasingly influenced by stringent energy efficiency regulations imposed by various governments. These regulations aim to reduce energy consumption and greenhouse gas emissions, thereby promoting sustainable practices. For instance, the implementation of standards such as the Energy Star program encourages manufacturers to develop appliances that utilize electric motors with higher efficiency ratings. This shift not only benefits consumers through lower utility bills but also drives innovation within the industry. As a result, manufacturers are compelled to invest in research and development to create more efficient electric motors, which could lead to a significant transformation in the market landscape.

Shift Towards Smart Appliances

The shift towards smart appliances is a defining trend in the Electric Motors Household Appliances Market. As technology continues to advance, consumers are increasingly drawn to appliances that offer connectivity and automation features. Smart appliances equipped with electric motors can be controlled remotely, providing convenience and enhancing user experience. This trend is supported by the growing adoption of smart home technologies, which is projected to expand in the coming years. Manufacturers are responding to this demand by integrating advanced electric motors into their products, enabling features such as energy monitoring and automated operation. This evolution not only enhances the functionality of household appliances but also positions the market for sustained growth.