Electric Motor Market Summary

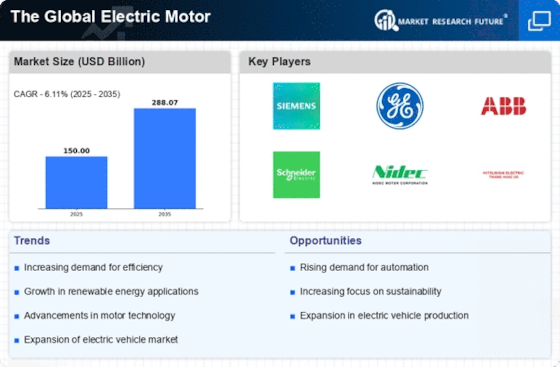

As per Market Research Future analysis, The Electric Motor Market Size was estimated at 150.0 USD Billion in 2024. The electric motor industry is projected to grow from 159.17 USD Billion in 2025 to 288.07 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Electric Motor Market is poised for substantial growth driven by sustainability and technological advancements.

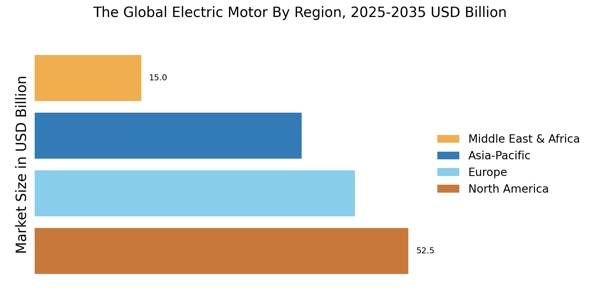

- North America remains the largest market for electric motors, driven by industrial automation and renewable energy initiatives.

- Asia-Pacific is recognized as the fastest-growing region, reflecting a surge in electrification of transportation and HVAC equipment demand.

- AC motors dominate the market, while DC motors are experiencing rapid growth due to their efficiency and versatility in applications.

- Key market drivers include a strong sustainability focus and the ongoing electrification of transportation, which are reshaping industry dynamics.

Market Size & Forecast

| 2024 Market Size | 150.0 (USD Billion) |

| 2035 Market Size | 288.07 (USD Billion) |

| CAGR (2025 - 2035) | 6.11% |

Major Players

Siemens (DE), General Electric (US), ABB (CH), Schneider Electric (FR), Nidec Corporation (JP), Mitsubishi Electric (JP), Emerson Electric (US), Rockwell Automation (US), Regal Beloit (US)