Consumer Awareness and Education

The Automotive Electric Motors Market is increasingly shaped by consumer awareness and education regarding the benefits of electric vehicles. As information about the environmental and economic advantages of electric mobility becomes more accessible, consumers are more inclined to consider electric vehicles as viable alternatives to traditional vehicles. Educational campaigns and outreach programs are playing a pivotal role in dispelling myths and providing insights into the advantages of electric motors. This heightened awareness is expected to drive demand in the Automotive Electric Motors Market, as more consumers recognize the long-term savings associated with electric vehicles. The growing interest in sustainable transportation solutions suggests a promising outlook for the market as consumer preferences continue to evolve.

Rising Electric Vehicle Adoption

The Automotive Electric Motors Market is experiencing a notable surge in demand due to the increasing adoption of electric vehicles (EVs). As consumers become more environmentally conscious, the shift towards EVs is accelerating. In 2025, it is estimated that the share of electric vehicles in total vehicle sales could reach approximately 30%, driven by advancements in battery technology and charging infrastructure. This transition is not merely a trend; it represents a fundamental change in consumer preferences, which is likely to propel the Automotive Electric Motors Market forward. The growing number of manufacturers entering the EV space further indicates a robust market potential, as traditional automakers pivot towards electric offerings to meet evolving consumer expectations.

Government Incentives and Regulations

The Automotive Electric Motors Market is significantly influenced by government incentives and regulations aimed at promoting electric mobility. Various countries have implemented policies that encourage the adoption of electric vehicles, including tax rebates, subsidies, and stricter emissions standards. For instance, some regions have set ambitious targets for phasing out internal combustion engine vehicles, which could lead to a substantial increase in electric vehicle sales. These regulatory frameworks not only stimulate demand for electric vehicles but also create a favorable environment for the Automotive Electric Motors Market to thrive. As governments continue to prioritize sustainability, the market is likely to benefit from ongoing support and investment in electric mobility initiatives.

Technological Innovations in Electric Motors

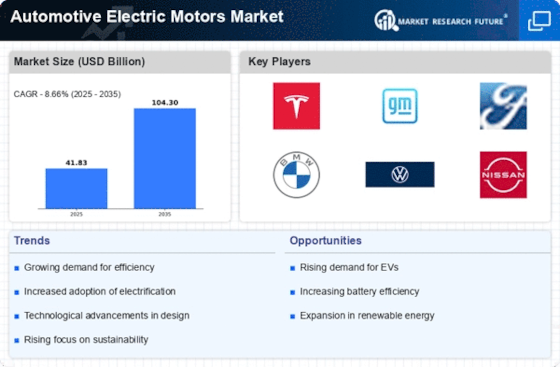

The Automotive Electric Motors Market is witnessing rapid technological innovations that enhance the performance and efficiency of electric motors. Developments in motor design, materials, and control systems are contributing to improved energy efficiency and reduced costs. For example, advancements in permanent magnet motors and induction motors are making electric vehicles more competitive with traditional vehicles. The market for electric motors is projected to grow at a compound annual growth rate (CAGR) of around 10% over the next five years, reflecting the impact of these innovations. As manufacturers continue to invest in research and development, the Automotive Electric Motors Market is poised for significant growth, driven by enhanced motor capabilities and performance.

Increasing Investment in Charging Infrastructure

The Automotive Electric Motors Market is also benefiting from the increasing investment in charging infrastructure, which is crucial for the widespread adoption of electric vehicles. As more charging stations are installed, the convenience of owning an electric vehicle improves, thereby attracting more consumers. In 2025, the number of public charging stations is expected to exceed 1 million, facilitating easier access to charging for electric vehicle owners. This expansion of infrastructure not only supports the growth of the electric vehicle market but also directly influences the Automotive Electric Motors Market by increasing the demand for electric motors. The synergy between electric vehicle adoption and charging infrastructure development is likely to create a robust ecosystem that fosters market growth.