Regulatory Support and Incentives

Regulatory frameworks and incentives play a crucial role in shaping the Copper In Electric Vehicle Charging Infrastructure Market. Many governments are implementing policies that promote the installation of EV charging stations, offering tax credits and subsidies to encourage private investment. These initiatives are designed to accelerate the transition to electric mobility, thereby increasing the demand for charging infrastructure. For instance, some regions have set ambitious targets for EV adoption, which directly correlates with the need for a robust charging network. As these regulations evolve, the Copper In Electric Vehicle Charging Infrastructure Market is likely to see increased activity, as stakeholders respond to the favorable policy environment and invest in necessary infrastructure.

Rising Demand for Electric Vehicles

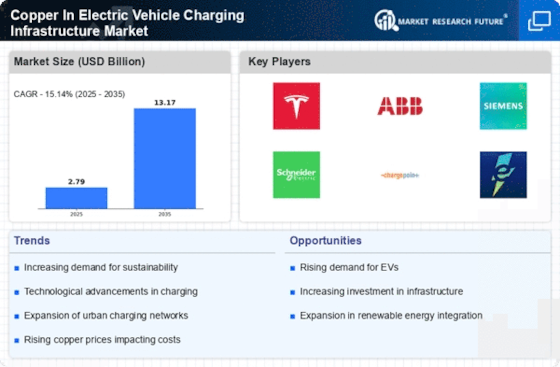

The increasing adoption of electric vehicles (EVs) is a primary driver for the Copper In Electric Vehicle Charging Infrastructure Market. As consumers become more environmentally conscious, the demand for EVs has surged, with sales projected to reach over 30 million units annually by 2030. This growth necessitates a robust charging infrastructure, which relies heavily on copper for its excellent conductivity and durability. The expansion of EV models across various segments, including passenger cars and commercial vehicles, further amplifies the need for efficient charging solutions. Consequently, the Copper In Electric Vehicle Charging Infrastructure Market is poised to benefit from this rising demand, as manufacturers and service providers seek to establish comprehensive charging networks to support the growing fleet of electric vehicles.

Investment in Charging Infrastructure

Significant investments in charging infrastructure are propelling the Copper In Electric Vehicle Charging Infrastructure Market forward. Governments and private entities are allocating substantial funds to develop extensive charging networks, with estimates suggesting that investments could exceed $100 billion by 2030. This influx of capital is directed towards the installation of fast-charging stations, which require high-quality copper wiring to ensure optimal performance. Additionally, the establishment of charging hubs in urban areas and along major highways is becoming increasingly common, further driving the demand for copper. As the infrastructure expands, the Copper In Electric Vehicle Charging Infrastructure Market is likely to experience robust growth, driven by the need for reliable and efficient charging solutions.

Growing Awareness of Environmental Impact

The growing awareness of environmental issues is driving the Copper In Electric Vehicle Charging Infrastructure Market. As climate change concerns escalate, consumers and businesses alike are seeking sustainable alternatives to traditional fossil fuel vehicles. This shift in mindset is leading to a greater emphasis on electric vehicles, which require a comprehensive charging infrastructure. The demand for copper, known for its recyclability and low environmental impact, aligns well with these sustainability goals. Furthermore, as more organizations commit to reducing their carbon footprints, the need for efficient and accessible charging solutions becomes paramount. This trend is likely to bolster the Copper In Electric Vehicle Charging Infrastructure Market, as stakeholders prioritize environmentally friendly materials and practices in their operations.

Technological Innovations in Charging Solutions

Technological advancements in charging solutions are significantly influencing the Copper In Electric Vehicle Charging Infrastructure Market. Innovations such as ultra-fast charging technology and wireless charging systems are emerging, necessitating the use of high-grade copper for efficient energy transfer. The development of smart charging stations, which can optimize energy usage and integrate with renewable energy sources, is also gaining traction. These advancements not only enhance the user experience but also improve the overall efficiency of charging networks. As these technologies become more prevalent, the demand for copper in the Electric Vehicle Charging Infrastructure Market is expected to rise, driven by the need for high-performance materials that can support these cutting-edge solutions.