Labor Shortages

Labor shortages across various industries are increasingly influencing the Global Service Robotics Market Industry. Many sectors, including hospitality, retail, and healthcare, face challenges in recruiting and retaining skilled workers. Service robots can effectively fill these gaps by performing repetitive and labor-intensive tasks, allowing human workers to focus on more complex responsibilities. This trend is particularly evident in regions experiencing significant workforce declines. As organizations adopt robotic solutions to mitigate labor shortages, the market is anticipated to grow at a compound annual growth rate of 9.21% from 2025 to 2035, reflecting a shift towards automation in the workforce.

Aging Population

An increasingly aging global population significantly drives the Global Service Robotics Market Industry. As the number of elderly individuals rises, there is a growing need for assistance in daily activities, healthcare, and companionship. Service robots, such as robotic caregivers and telepresence systems, provide essential support to the elderly, enhancing their quality of life. This demographic shift is expected to contribute to the market's expansion, with projections indicating a potential market size of 120.34 USD Billion by 2035. The integration of service robots in elder care settings may alleviate the burden on healthcare systems, thereby fostering a sustainable solution for aging societies.

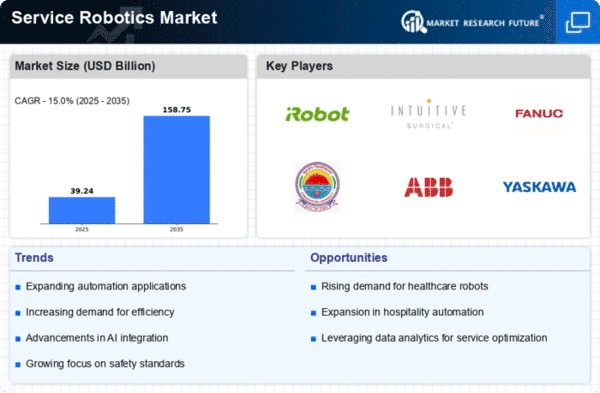

Market Growth Projections

The Global Service Robotics Market Industry is projected to experience substantial growth over the coming years. With a market size expected to reach 45.67 USD Billion in 2024, the industry is on a trajectory to expand significantly, potentially reaching 120.34 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 9.21% from 2025 to 2035, indicating a robust demand for service robots across various sectors. The increasing integration of automation in everyday tasks, coupled with advancements in technology, positions the service robotics market as a pivotal player in the global economy.

Rising Consumer Acceptance

Consumer acceptance of service robotics is steadily increasing, contributing to the growth of the Global Service Robotics Market Industry. As individuals become more familiar with robotic technologies in their daily lives, such as robotic vacuum cleaners and personal assistants, their willingness to adopt more advanced service robots rises. This shift in perception is crucial for the market's expansion, as it encourages manufacturers to innovate and diversify their product offerings. The growing acceptance of service robots in various sectors, including healthcare and hospitality, suggests a promising future for the industry, potentially leading to a market size of 120.34 USD Billion by 2035.

Technological Advancements

The Global Service Robotics Market Industry is propelled by rapid technological advancements in artificial intelligence, machine learning, and robotics. These innovations enhance the capabilities of service robots, enabling them to perform complex tasks with greater efficiency and accuracy. For instance, robots equipped with advanced sensors and AI algorithms can navigate dynamic environments, making them suitable for applications in healthcare, hospitality, and logistics. As these technologies continue to evolve, the market is projected to reach 45.67 USD Billion in 2024, reflecting a growing demand for intelligent automation solutions across various sectors.

Increased Investment in Automation

The Global Service Robotics Market Industry benefits from increased investment in automation technologies by both private and public sectors. Governments and enterprises are recognizing the potential of service robots to enhance productivity and operational efficiency. For example, initiatives aimed at promoting smart manufacturing and automation in logistics are gaining traction globally. This influx of capital not only accelerates the development of innovative robotic solutions but also fosters collaboration between technology providers and end-users. As a result, the market is poised for substantial growth, with expectations of reaching 45.67 USD Billion by 2024, driven by these investments.