Market Trends

Introduction

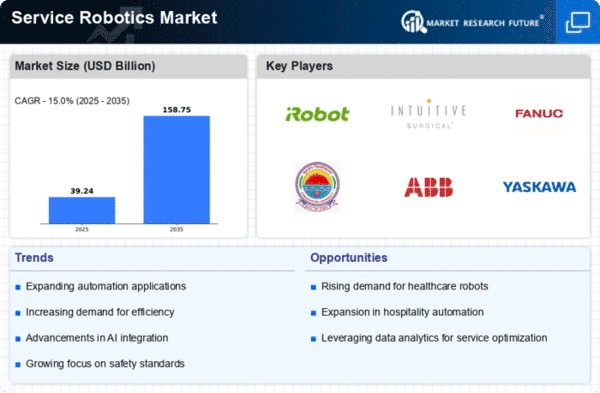

The service robots market will be subject to great changes by 2024. These changes will be a result of the combination of a number of macro-economic factors, such as rapid technological progress, changes in regulatory frameworks, and changing customer behavior. Artificial intelligence, machine learning, and automation are enhancing the capabilities and the number of service robot applications in various industries, from healthcare to logistics. While at the same time, regulatory frameworks are shaping the implementation and integration of these new technologies, ensuring safety and compliance while promoting innovation. Also, the growing demand for automation is driven by the growing customer expectations for more convenient and more efficient services. This report explains the trends that will shape the market and the opportunities that will arise from them.

Top Trends

-

Increased Adoption in Healthcare

In recent years, hospitals have been deploying more and more service robots for surgery and patient care, with Intuitive Surgical leading the way in surgical robots. A recent survey found that by 2025, seven out of ten hospitals intend to invest in robots. This trend will enhance the hospital’s operational efficiency and improve patient outcomes, while reducing the length of recuperation time. Artificial intelligence and telemedicine will further expand the role of robots in the field of medicine. -

Expansion in Logistics and Warehousing

Amazon is introducing automation into the warehouses. Some recent figures show that sixty per cent of the logistics companies are now using robots to improve efficiency. This is reducing labour costs and speeding up order fulfilment. The next stage will be the automation of the supply chains, which will change the whole logistics landscape. -

Rise of Collaborative Robots (Cobots)

In the manufacturing industry, companies like KUKA and Fanuc are already gaining ground with the development of so-called co-robots. A survey shows that 4 out of 10 manufacturers are already using these co-robots to enhance human-robot collaboration. Productivity and safety are both increasing, as the repetitive work is being taken over by robots. The next step is to develop advanced AI, which will enable the human-robot team to work more effectively. -

Smart Home Robotics Growth

And with it the demand for smart home robots, such as iRobot’s. In fact, according to one survey, by 2025, half of all households will have bought such a device. And it is this trend that is driving innovation in the fields of home automation and energy efficiency. And the next step could be the development of smarter AI-based home management, further integrating robots into our daily lives. -

Government Initiatives and Funding

In the field of research and development, governments all over the world are investing in the field of robots. The European Union's Horizon 2020 program is one example. In the last two years, the amount of public funding for robots has increased by 30 percent. This trend promotes innovation and speeds up the introduction of robots in all industries. This may lead to more standardization in regulations and to support for young companies in the field of robots. -

Focus on Autonomous Delivery Solutions

Companies like Nuro are experimenting with robots that can deliver packages on their own, in response to the growing demand for contactless services. They claim that forty percent of consumers would prefer to have their packages delivered by robots after the pandemic. This trend is transforming the last-mile logistics industry and reducing delivery times. In the future, it may be adopted more widely in cities, improving the convenience and efficiency of delivery services. -

Integration of AI and Machine Learning

Artificial intelligence and machine learning have been combined in service robots, thereby increasing their abilities. Cyberdyne leads in this field. The efficiency of these robots is estimated to increase by as much as 50 percent. This trend is transforming industries by enabling robots to learn new skills and adapt to new tasks. It may lead to fully self-governing robots capable of making complex decisions. -

Sustainability and Eco-Friendly Robotics

It is not surprising that the use of robots is becoming more and more important in the field of environment. Blue Ocean Robotics, for example, is a company specialized in eco-robotics. There is a study showing that 55% of consumers prefer the products of companies that take care of the environment. This trend is driving innovation in energy-efficient robots and in the use of sustainable materials. And there may be robots designed for the observation and conservation of the environment. -

Enhanced Safety Protocols in Robotics

The safety of robots is being made more strict, especially in industrial robots. Yaskawa Electric is at the forefront of this trend. It has been found that by implementing safety measures, the accident rate at factories can be reduced by 40 per cent. The trend is also an important factor in obtaining the acceptance of the workforce and the approval of the government. There will be more advanced safety standards in the future. -

Telepresence and Remote Operations

For remote operations, telepresence robots are becoming increasingly popular, with companies such as Savioke developing them. A survey showed that 65% of companies are interested in using telepresence solutions for remote collaboration. The trend enhances the communication and efficiency of remote operations. In the future, the experience of telepresence may become more and more realistic, bridging the gap between remote and on-site work.

Conclusion: Navigating the Service Robotics Landscape

The service robots market is characterised by strong competition and fragmentation. The well-established players are deploying their experience and know-how in artificial intelligence and automation, while new entrants are focusing on innovation and solutions with a strong emphasis on flexibility and scalability. The regional trends point to a growing demand for service robots in North America and Asia-Pacific, driven by technological advances and rising labour costs. In the foreseeable future, the leading players will be those who are able to integrate artificial intelligence, put sustainable development first and offer flexible solutions. The trends must be carefully watched to take advantage of opportunities and avoid risks.

Leave a Comment