Service Robotics Size

Market Size Snapshot

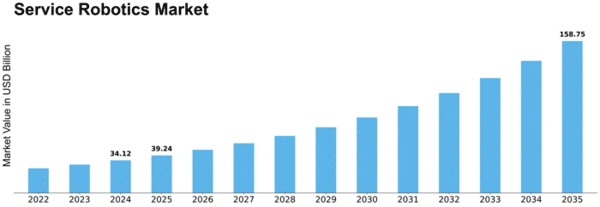

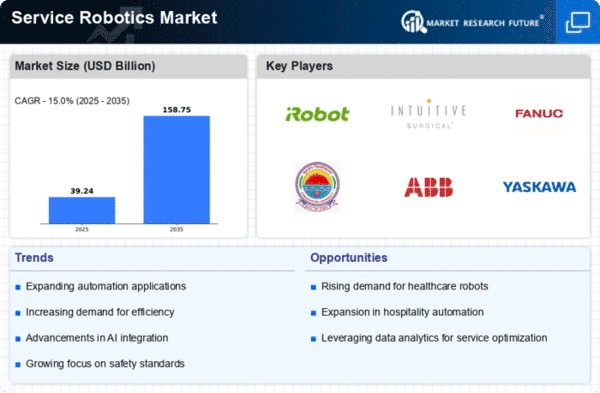

| Year | Value |

|---|---|

| 2024 | USD 34.12 Billion |

| 2035 | USD 158.75 Billion |

| CAGR (2025-2035) | -4.02 % |

Note – Market size depicts the revenue generated over the financial year

The Service Robotics Market is expected to grow at a CAGR of 14.3 percent from 2024 to 2035, from a current market size of $34.1 billion. This growth is attributed to the high demand for automation in various industries. Despite this, the CAGR for the period 2025 to 2035 is expected to be -4.3 percent. This decline in the CAGR may be attributed to market saturation or a change in the preferences of consumers. In either case, this may require industry players to change their strategies to maintain growth. The market is mainly driven by technological developments such as advances in artificial intelligence, machine learning, and sensors. These developments have enhanced the capabilities and applications of service robots in industries such as logistics, medical, and hospitality. In addition, companies such as iRobot, Intuitive Surgical, and Softbank are investing heavily in research and development, which has led to the development of increasingly advanced robots. These companies are also launching new products and forming strategic alliances to take advantage of the emerging opportunities and address the changing needs of consumers in an increasingly automated world.

Regional Market Size

Regional Deep Dive

The Service Robotics Market is growing significantly across the globe, owing to technological advancements, rising demand for automation, and a shift towards improving operational efficiency. Each region reflects its own unique characteristics, influenced by the cultural, economic, and regulatory factors, which in turn affect the adoption and development of service robots. North America is the most advanced in terms of investment and innovation. Europe is more focused on the regulatory framework and sustainability. Asia-Pacific is growing rapidly with a strong manufacturing base. The Middle East and Africa are emerging as promising markets for the service robots. Latin America is slowly but steadily adopting automation across various industries.

Europe

- The European Union has introduced the 'Digital Europe Programme,' which allocates funding for the development of AI and robotics, fostering collaboration among member states and enhancing the region's technological capabilities.

- The governments of countries like Germany and France are investing heavily in the development of robots. The German Robotics Initiative, for example, is an ambitious project to promote the integration of robots in various industries, especially in manufacturing and logistics.

Asia Pacific

- Japan continues to be a leader in service robotics, with companies like SoftBank Robotics and Fanuc developing advanced humanoid and industrial robots, reflecting the country's aging population and labor shortages.

- China's government has launched the 'Made in China 2025' initiative, which emphasizes the importance of robotics and automation in manufacturing, leading to increased investments and rapid advancements in service robotics technology.

Latin America

- Brazil is emerging as a key player in the service robotics market, with local companies like Aker Solutions developing robots for agriculture and mining, addressing the region's specific economic needs.

- Government programs in countries like Mexico are beginning to support the adoption of robotics in manufacturing, aiming to enhance competitiveness and attract foreign investment in the technology sector.

North America

- The U.S. is witnessing a surge in the deployment of service robots in healthcare, particularly in hospitals and elder care facilities, with companies like Intuitive Surgical and iRobot leading the charge.

- Recent regulatory changes in the U.S. have streamlined the approval process for robotic devices, encouraging innovation and faster market entry for new technologies, which is expected to enhance competition and drive growth.

Middle East And Africa

- The UAE is at the forefront of adopting service robotics, with initiatives like the Dubai Robotics and AI Strategy aiming to integrate robotics into various sectors, including tourism and healthcare.

- South Africa is seeing growth in the use of service robots in agriculture, driven by the need for efficiency and productivity in the sector, with local startups developing innovative robotic solutions tailored to the region's unique challenges.

Did You Know?

“By 2025, it is estimated that service robots will perform over 50% of tasks in sectors like healthcare and hospitality, significantly transforming how services are delivered.” — International Federation of Robotics (IFR)

Segmental Market Size

Among the most important areas of growth for the Service Robotics Market are the areas of medicine and logistics. This growth is based on the growing demand for automation, the development of artificial intelligence, and the need for efficient service in various industries. In addition, the government's support for automation in the medical and manufacturing industries is also driving this market's growth. The stage of development varies from application to application: whereas the medical field is already deploying robots in large numbers, with companies such as Intuitive Surgical focusing on surgical robots, logistics robots are currently gaining traction in warehouses, for example with Amazon's Kiva robots. These applications include surgical robots, hospital cleaning robots, and robots that deliver packages in urban areas. Meanwhile, macro-economic trends such as the flu pandemic are accelerating the shift towards automation as businesses try to avoid contact with humans. In addition, the capabilities of service robots are being enhanced by machine learning, computer vision, and the Internet of Things.

Future Outlook

The Service Robotics Market is slated to grow from $34,112,000,000 to $158,750,000,000. This growth is attributed to the increasing automation across various industries, including healthcare, hospitality, and logistics. As companies look to enhance their operational efficiency and reduce labor costs, the penetration of service robots is expected to increase substantially, with a potential penetration of up to 25% in key industries by 2035. This growth is attributed to the advancements in artificial intelligence, machine learning, and sensors, which enable robots to perform more complex tasks with greater autonomy and reliability. Also, the integration of data analytics with AI-driven insights will further drive the growth of this market. Government initiatives to promote automation and innovation will also accelerate the market growth. Collaborative robots, which work alongside humans, and an increasing focus on sustainable and energy-efficient robot designs will also have a positive impact on the market. These trends will create new opportunities for stakeholders and will alter the competitive landscape of the market.

Leave a Comment