Market Share

Introduction: Navigating the Competitive Landscape of Service Robotics

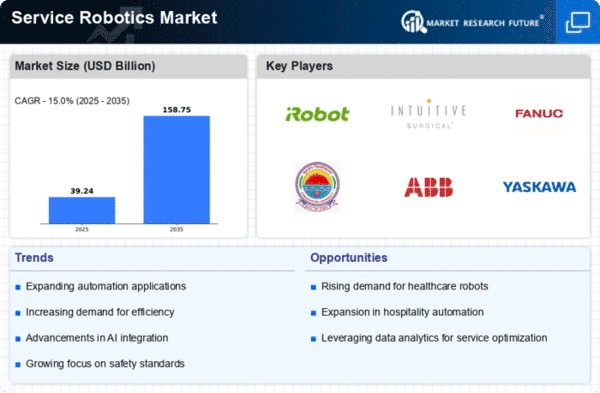

The service robots market is experiencing unprecedented competition, driven by a rapid technological advance, a changing regulatory framework, and the growing demand for efficiency and personalization. Competition is rife among the major robot manufacturers, IT companies, and a number of artificial intelligence start-ups. The leading players are now deploying advanced capabilities such as data analysis, automation, and IoT integration. Product reliability and the user experience are the main focus of the robot manufacturers, while the IT companies are putting a premium on seamless integration and data security. The start-ups are focusing on biometrics and green technology to differentiate their offerings and attract consumers who are more concerned about the environment. The key strategic trends in the market are a shift towards cobots and self-driving systems in the service industries, especially in the Asia-Pacific and North American regions. The dynamic nature of the market requires a thorough understanding of the technological and strategic trends in order to take advantage of the evolving opportunities.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate various robotic technologies for diverse applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| ABB | Strong automation expertise | Industrial robotics and automation | Global |

| KUKA | Advanced robotics and automation solutions | Industrial and service robotics | Global |

| Yaskawa Electric | Robust motion control technology | Industrial robotics and automation | Global |

| Fanuc | Leading in CNC and robotics | Industrial automation and robotics | Global |

Specialized Technology Vendors

These vendors focus on niche applications and innovative technologies within the service robotics sector.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Intuitive Surgical | Pioneering robotic surgical systems | Surgical robotics | Global |

| Cyberdyne | Innovative exoskeleton technology | Medical and rehabilitation robotics | Global |

| iRobot | Consumer robotics leader | Home cleaning robots | North America, Europe |

| Nuro | Autonomous delivery solutions | Last-mile delivery robotics | North America |

Infrastructure & Equipment Providers

These vendors provide essential components and infrastructure that support robotic systems and applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Amazon Robotics | Integration with e-commerce logistics | Warehouse automation | North America, Europe |

| SoftBank Robotics | Human-robot interaction expertise | Service and social robots | Global |

| Adept Technology | Flexible automation solutions | Industrial and service robotics | North America, Europe |

| Blue Ocean Robotics | Focus on service robots for healthcare | Healthcare and service robotics | Global |

| Savioke | Robots for hospitality and service | Service robots for hospitality | North America |

| Honda | Innovative mobility solutions | Personal mobility and robotics | Global |

| Teradyne | Testing and automation solutions | Automation and robotics testing | Global |

Emerging Players & Regional Champions

- Pudu Robotics (China): Specializes in service robots for the hospitality and healthcare sectors, recently secured contracts with major hotel chains in Asia, complementing established vendors by offering cost-effective and efficient solutions.

- Savioke (USA): Focuses on delivery robots for hotels and hospitals, recently implemented their robots in several major hospitals in California, challenging established players by emphasizing user-friendly interfaces and customer service.

- It is a swarm of little robots, and is destined to be used in various industries, especially in the field of retail and logistics. It is a German company which has recently entered into a partnership with a large retail chain for in-store assistance.

- Nuro (USA): Develops autonomous delivery robots for last-mile logistics, recently expanded operations in urban areas, challenging established logistics providers by focusing on small-scale deliveries and efficiency.

- Kiwibot (Colombia): Provides delivery robots for food and retail sectors, recently launched services in multiple Latin American cities, complementing existing delivery services by targeting local businesses and enhancing last-mile delivery.

Regional Trends: The Service Robots Market is expected to be driven by the increasing demand for automation in hospitality, health, and logistics in 2024. Specialization is focused on the development of artificial intelligence for navigation and interaction with users. The focus is on improving the customer experience and the efficiency of operations.

Collaborations & M&A Movements

- Boston Dynamics and SoftBank Robotics entered a partnership to integrate advanced AI capabilities into their service robots, aiming to enhance operational efficiency in logistics and retail sectors.

- iRobot acquired the startup Roborock in early 2024 to expand its product offerings in home cleaning robots, thereby increasing its market share in the competitive consumer robotics space.

- Amazon and Google collaborated to develop a new line of service robots for warehouse automation, leveraging their respective strengths in cloud computing and machine learning to improve supply chain efficiency.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | SITA, Gemalto | SITA has implemented biometric self-boarding solutions in over 50 airports globally, enhancing passenger flow and reducing boarding times. Gemalto's solutions are noted for their high security and integration with existing systems. |

| AI-Powered Ops Mgmt | IBM, Siemens | IBM's Watson AI is utilized in operational management for predictive maintenance, significantly reducing downtime. Siemens has integrated AI in their robotics for real-time decision-making, improving efficiency in logistics. |

| Border Control | Thales, NEC | Thales has deployed advanced biometric border control systems in multiple countries, streamlining the immigration process. NEC's facial recognition technology is recognized for its accuracy and speed, enhancing security measures. |

| Sustainability | KUKA, ABB | KUKA focuses on energy-efficient robotics solutions, reducing carbon footprints in manufacturing. ABB's robots are designed for energy savings and are used in sustainable production processes, showcasing their commitment to green technology. |

| Passenger Experience | SoftBank Robotics, Robotemi | SoftBank Robotics' Pepper robot enhances passenger experience through interactive engagement in airports. Robotemi's Temi robot provides personalized assistance, improving customer satisfaction and operational efficiency. |

Conclusion: Navigating the Service Robotics Landscape

As we approach 2024, the service robots market is characterized by a highly competitive and fragmented environment, where the legacy and emerging players are vying for market share. In terms of regional trends, North America and Asia-Pacific are growing the fastest, driven by the advancements in AI and automation. Strategically, vendors are expected to position themselves to meet the evolving customer needs. The incumbents are investing in their technological foundations, while the emerging players are innovating rapidly to capture the niche markets. In the end, the ability to integrate AI, automate processes and offer sustainable solutions will be the key to establishing a strong position in this dynamic market.

Leave a Comment