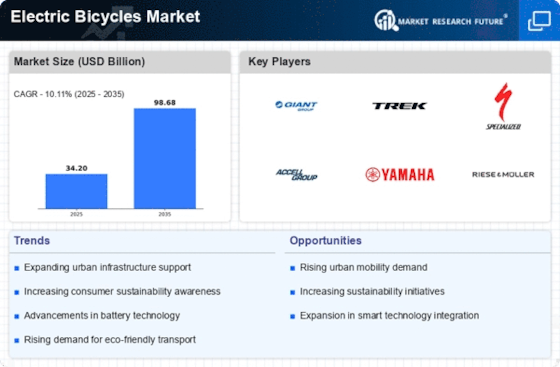

Rising Urbanization

The increasing trend of urbanization appears to be a pivotal driver for the Electric Bicycles Market. As more individuals migrate to urban areas, the demand for efficient and eco-friendly transportation solutions intensifies. Urban environments often face congestion and pollution challenges, making electric bicycles an attractive alternative. In fact, studies indicate that urban areas with high population density are likely to see a surge in electric bicycle adoption, as they offer a practical solution for short-distance travel. The Electric Bicycles Market is thus positioned to benefit from this demographic shift, as city dwellers seek sustainable commuting options that alleviate traffic woes and reduce their carbon footprint.

Environmental Concerns

Heightened awareness of environmental issues is driving the Electric Bicycles Market forward. As climate change and pollution become increasingly pressing concerns, consumers are seeking sustainable alternatives to traditional vehicles. Electric bicycles Market present a lower carbon footprint option, appealing to environmentally conscious individuals. Market data suggests that regions with higher environmental awareness are witnessing a more rapid adoption of electric bicycles. This trend indicates that the Electric Bicycles Market is likely to expand as more consumers prioritize eco-friendly transportation methods, aligning their purchasing decisions with their values regarding sustainability.

Technological Innovations

Technological advancements are transforming the Electric Bicycles Market in profound ways. Innovations such as improved battery technology, lightweight materials, and smart connectivity features are enhancing the performance and appeal of electric bicycles. For example, the development of lithium-ion batteries has significantly increased the range and efficiency of electric bicycles, making them more practical for daily use. Furthermore, the integration of smart technology, such as GPS and fitness tracking, is attracting tech-savvy consumers. As these technologies continue to evolve, the Electric Bicycles Market is poised for substantial growth, appealing to a broader audience seeking modern transportation solutions.

Health and Fitness Awareness

The growing awareness of health and fitness among consumers is another significant driver for the Electric Bicycles Market. As individuals increasingly prioritize physical well-being, electric bicycles offer a unique blend of exercise and convenience. They allow users to engage in physical activity while providing the option to reduce effort through electric assistance. This dual benefit appeals to a wide range of demographics, from fitness enthusiasts to those seeking a more leisurely ride. The Electric Bicycles Market is thus likely to see an uptick in demand as more consumers recognize the health benefits associated with cycling, even in its electric form.

Government Initiatives and Incentives

Government policies and incentives play a crucial role in shaping the Electric Bicycles Market. Many governments are actively promoting the use of electric bicycles through subsidies, tax breaks, and infrastructure development. For instance, various countries have implemented programs to encourage the adoption of electric bicycles as part of their broader environmental goals. This support not only enhances consumer accessibility but also fosters a favorable market environment. The Electric Bicycles Market is likely to experience growth as these initiatives lower the financial barriers for potential buyers, making electric bicycles a more viable option for everyday transportation.