Aging Population

Japan's aging population presents a unique opportunity for the electric bicycles market. As the demographic landscape shifts, older adults are increasingly seeking mobility solutions that accommodate their needs. Electric bicycles offer a user-friendly option for seniors, providing assistance with pedaling and making cycling more accessible. In 2025, it is estimated that over 30% of the population will be aged 65 and older, creating a substantial market segment for electric bicycles. This demographic shift may lead to increased demand for models specifically designed for older riders, emphasizing comfort and ease of use. Consequently, the electric bicycles market is likely to see growth as manufacturers cater to this aging demographic, enhancing their product offerings to meet the needs of older consumers.

Rising Fuel Prices

The escalating fuel prices in Japan are prompting consumers to explore alternative transportation options, thereby benefiting the electric bicycles market. As fuel costs continue to rise, individuals are increasingly seeking cost-effective and efficient means of travel. Electric bicycles present a viable solution, offering lower operational costs compared to traditional vehicles. In 2025, it is anticipated that fuel prices will increase by approximately 15%, further incentivizing consumers to consider electric bicycles as a practical alternative. This economic pressure may lead to a shift in consumer behavior, with more individuals opting for electric bicycles to mitigate transportation expenses. As a result, the electric bicycles market is likely to experience growth as consumers prioritize affordability and sustainability in their commuting choices.

Environmental Awareness

Growing environmental consciousness among Japanese consumers is significantly influencing the electric bicycles market. As awareness of climate change and pollution rises, individuals are increasingly seeking sustainable transportation options. The electric bicycles market aligns with these values, offering a greener alternative to traditional vehicles. In 2025, surveys indicate that over 70% of Japanese consumers prioritize eco-friendly products, which is likely to drive the adoption of electric bicycles. Furthermore, the government has been promoting initiatives to reduce carbon emissions, which may further encourage consumers to transition to electric bicycles. This heightened environmental awareness is expected to create a favorable landscape for the electric bicycles market, as more people recognize the benefits of reducing their carbon footprint.

Technological Integration

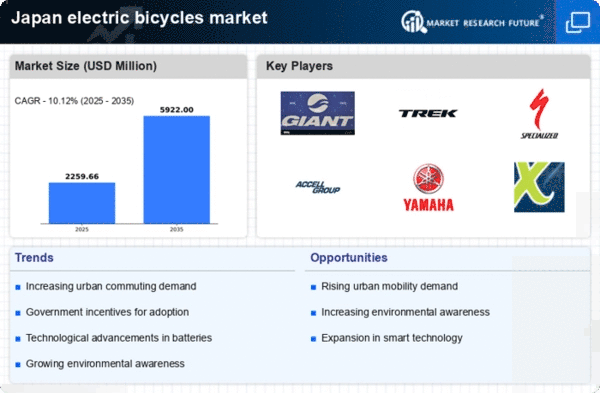

The integration of advanced technologies into electric bicycles market is reshaping consumer expectations and experiences. Innovations such as smart connectivity, GPS navigation, and enhanced battery efficiency are becoming increasingly prevalent. In Japan, the market is witnessing a surge in demand for electric bicycles equipped with smart features, which enhance user convenience and safety. By 2025, it is projected that around 40% of electric bicycles sold will incorporate smart technology, appealing to tech-savvy consumers. This trend not only improves the functionality of electric bicycles but also positions them as desirable lifestyle products. As manufacturers continue to innovate, the electric bicycles market is likely to expand, attracting a broader audience seeking modern and efficient transportation solutions.

Urbanization and Commuting Needs

The rapid urbanization in Japan is driving the demand for electric bicycles market. As cities become more congested, commuters seek efficient and eco-friendly transportation alternatives. The electric bicycles market is positioned to benefit from this trend, as these vehicles offer a practical solution for navigating urban environments. In 2025, it is estimated that approximately 80% of the Japanese population will reside in urban areas, further increasing the need for compact and sustainable commuting options. Additionally, the rising costs of public transportation may lead consumers to consider electric bicycles as a cost-effective alternative. This shift in commuting preferences is likely to bolster the electric bicycles market, as more individuals opt for personal mobility solutions that align with their urban lifestyles.