Emergence of EdTech Startups

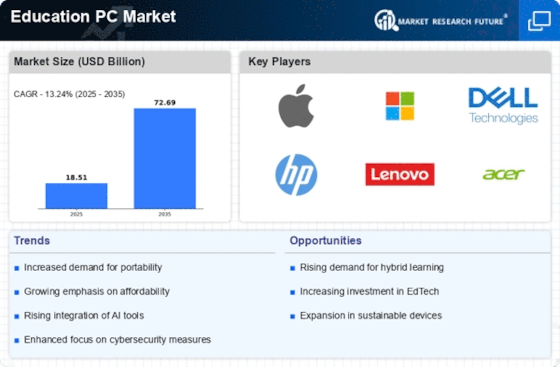

The rise of EdTech startups is significantly influencing the Education PC Market. These innovative companies are developing cutting-edge educational technologies that enhance learning experiences and improve student engagement. Many startups focus on creating software and applications that require robust computing devices, thereby driving demand for high-performance PCs in educational settings. Recent statistics indicate that investment in EdTech startups has surged, with funding reaching over 10 billion dollars in the past year alone. This influx of capital is likely to spur further innovation and competition within the Education PC Market, as traditional educational institutions seek to integrate these new technologies into their curricula.

Rising Focus on Digital Literacy

The emphasis on digital literacy is becoming increasingly pronounced within the Education PC Market. Educational institutions are recognizing the necessity of equipping students with essential digital skills to thrive in a technology-driven world. As a response, curricula are being adapted to include comprehensive digital literacy programs. Data suggests that nearly 80% of educators believe that digital literacy is critical for student success. This growing focus on digital skills is driving demand for PCs that can support various educational applications and platforms. Consequently, the Education PC Market is likely to expand as schools seek to provide students with the tools necessary to navigate the complexities of the digital landscape.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the Education PC Market. Various countries are implementing policies aimed at increasing access to technology in educational settings. For instance, funding programs are being established to provide schools with the resources needed to acquire modern computing devices. Reports suggest that government spending on educational technology has increased by over 15% in recent years. This financial support not only aids in the procurement of PCs but also encourages the development of innovative educational software. As a result, the Education PC Market is likely to benefit from sustained government investment, fostering an environment conducive to technological advancement in education.

Shift Towards Sustainable Technology

The Education PC Market is witnessing a shift towards sustainable technology as environmental concerns gain prominence. Educational institutions are increasingly prioritizing eco-friendly devices that minimize their carbon footprint. This trend is reflected in the growing demand for PCs made from recyclable materials and those designed for energy efficiency. Reports indicate that nearly 60% of schools are actively seeking sustainable technology solutions. As manufacturers respond to this demand by developing greener products, the Education PC Market is likely to evolve, with sustainability becoming a key factor in purchasing decisions. This shift not only benefits the environment but also aligns with the values of environmentally conscious students and educators.

Increased Demand for Remote Learning Tools

The Education PC Market experiences a notable surge in demand for remote learning tools. As educational institutions increasingly adopt hybrid and online learning models, the necessity for reliable and efficient personal computers becomes paramount. Data indicates that approximately 70% of educational institutions are investing in technology to enhance remote learning capabilities. This trend is likely to continue, as schools and universities recognize the importance of providing students with the necessary tools to succeed in a digital environment. Consequently, the Education PC Market is poised for growth, driven by the need for devices that support interactive learning experiences and facilitate communication between educators and students.