Technological Advancements

Rapid advancements in technology are significantly influencing the Augmented and Virtual Reality in Education Market. The development of more affordable and accessible AR and VR devices has made it feasible for educational institutions to integrate these technologies into their curricula. Innovations in software and hardware, such as improved graphics, user interfaces, and interactive capabilities, enhance the overall learning experience. Furthermore, the proliferation of mobile devices capable of supporting AR applications has expanded the reach of these technologies. As educational institutions increasingly recognize the potential of these advancements, the market is likely to experience substantial growth.

Increased Investment in EdTech

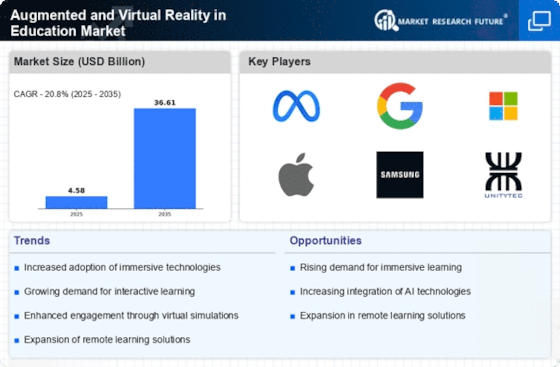

Investment in educational technology is a key driver of the Augmented and Virtual Reality in Education Market. As stakeholders recognize the transformative potential of AR and VR, funding for these technologies has surged. Educational institutions, private investors, and government bodies are increasingly allocating resources to develop and implement AR and VR solutions. Reports indicate that investment in EdTech is projected to reach billions of dollars in the coming years, with a significant portion directed towards immersive learning technologies. This influx of capital is expected to accelerate innovation and expand the availability of AR and VR tools in education.

Enhanced Engagement and Retention

The Augmented and Virtual Reality in Education Market appears to be driven by the need for enhanced student engagement and retention rates. Traditional educational methods often struggle to captivate students' attention, leading to disengagement. However, immersive technologies like AR and VR create interactive learning environments that stimulate curiosity and foster deeper understanding. Studies indicate that students using AR and VR tools demonstrate improved retention rates, with some reports suggesting increases of up to 75% in knowledge retention compared to conventional methods. This heightened engagement not only benefits students but also encourages educators to adopt these technologies, thereby propelling the market forward.

Support for Diverse Learning Styles

The Augmented and Virtual Reality in Education Market is increasingly recognized for its ability to support diverse learning styles. Students possess varying preferences and strengths when it comes to absorbing information, and traditional teaching methods may not cater to all. AR and VR technologies provide tailored learning experiences that accommodate visual, auditory, and kinesthetic learners. By offering interactive simulations and visualizations, these technologies enable students to engage with content in ways that resonate with their individual learning preferences. This adaptability is likely to drive further adoption of AR and VR in educational settings.

Growing Demand for Remote Learning Solutions

The Augmented and Virtual Reality in Education Market is experiencing a surge in demand for remote learning solutions. As educational institutions seek to provide flexible learning options, AR and VR technologies offer innovative ways to deliver content remotely. These immersive tools allow students to participate in virtual classrooms, engage in interactive simulations, and collaborate with peers from different locations. Market data suggests that the remote learning segment is expected to grow significantly, with projections indicating a compound annual growth rate of over 30% in the coming years. This trend underscores the importance of AR and VR in creating effective remote learning environments.