Technological Innovations

Technological advancements are reshaping the Earthmoving Equipment Market, leading to enhanced efficiency and productivity. Innovations such as telematics, automation, and electric machinery are becoming increasingly prevalent. For example, the integration of telematics systems allows for real-time monitoring of equipment performance, which can lead to reduced operational costs and improved maintenance schedules. The market for electric earthmoving equipment is also gaining traction, with projections indicating a potential growth rate of 10% over the next five years. These technological innovations not only improve the operational capabilities of earthmoving machinery but also align with sustainability goals, making them attractive to environmentally conscious companies. As a result, the Earthmoving Equipment Market is likely to see a shift towards more advanced and efficient machinery, catering to the evolving needs of the construction sector.

Infrastructure Development

The Earthmoving Equipment Market is experiencing a surge in demand due to extensive infrastructure development projects. Governments and private entities are investing heavily in the construction of roads, bridges, and urban facilities. For instance, the construction sector is projected to grow at a rate of 4.5% annually, which directly influences the demand for earthmoving equipment. This growth is driven by the need for modernized infrastructure to support urbanization and economic growth. As countries strive to enhance their infrastructure, the Earthmoving Equipment Market is likely to benefit significantly from increased procurement of machinery such as excavators, bulldozers, and loaders. Furthermore, the push for smart cities and sustainable urban planning is expected to further bolster the market, as advanced earthmoving equipment plays a crucial role in these initiatives.

Regulatory Frameworks and Standards

The Earthmoving Equipment Market is influenced by evolving regulatory frameworks and safety standards that govern construction practices. Governments are increasingly implementing stringent regulations aimed at ensuring safety and environmental sustainability in construction activities. Compliance with these regulations often necessitates the adoption of advanced earthmoving equipment that meets specific safety and emission standards. For instance, regulations regarding emissions from construction machinery are becoming more rigorous, prompting manufacturers to innovate and produce cleaner equipment. This shift not only enhances the safety of construction sites but also aligns with global sustainability goals. As a result, the Earthmoving Equipment Market is likely to see a rise in demand for equipment that adheres to these new standards, driving innovation and investment in cleaner technologies.

Rising Demand in Emerging Economies

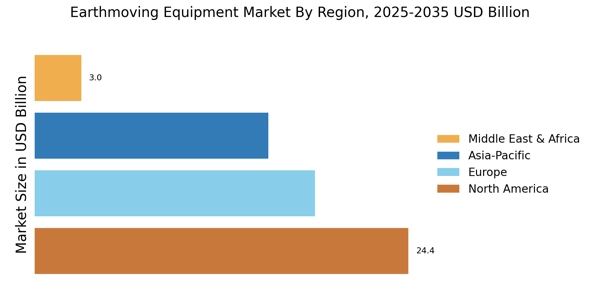

Emerging economies are becoming a focal point for the Earthmoving Equipment Market, driven by rapid industrialization and urbanization. Countries in Asia and Africa are witnessing significant growth in construction activities, which is expected to propel the demand for earthmoving equipment. For instance, the construction sector in Asia is anticipated to grow at a compound annual growth rate of 5.2% over the next decade. This growth is largely attributed to increased investments in infrastructure and housing projects. As these economies develop, the need for efficient earthmoving machinery becomes paramount, leading to a robust market for excavators, backhoes, and other equipment. Consequently, the Earthmoving Equipment Market is poised to capitalize on these opportunities, as manufacturers seek to expand their presence in these burgeoning markets.

Increased Investment in Renewable Energy Projects

The Earthmoving Equipment Market is witnessing a notable impact from increased investments in renewable energy projects. As countries strive to transition towards sustainable energy sources, the construction of solar farms, wind energy facilities, and other renewable projects is on the rise. This trend is expected to create a substantial demand for earthmoving equipment, as site preparation and land development are critical components of these projects. For instance, the renewable energy sector is projected to grow at a rate of 8% annually, which will likely necessitate the use of various earthmoving machinery. Consequently, the Earthmoving Equipment Market stands to benefit from this shift towards renewable energy, as companies seek efficient and reliable equipment to support their construction efforts in this sector.