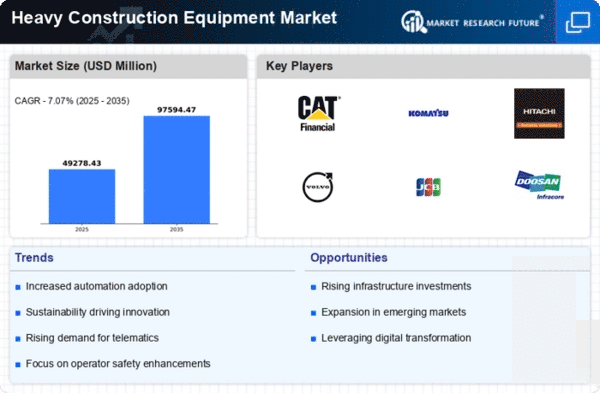

Market Growth Projections

The Europe Heavy Construction Equipment Market is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 7.07% from 2025 to 2035. This growth is driven by various factors, including increased infrastructure spending, urbanization, and technological advancements. The market is expected to reach a value of 97.5 USD Billion by 2035, reflecting the ongoing demand for heavy construction equipment across Europe. These projections highlight the industry's potential and the opportunities that lie ahead for stakeholders.

Urbanization and Population Growth

Urbanization continues to be a driving force in the Europe Heavy Construction Equipment Market, as cities expand and populations increase. The demand for residential and commercial construction is surging, leading to a heightened need for heavy machinery. As urban areas become more densely populated, the construction of high-rise buildings and infrastructure becomes imperative. This trend is likely to contribute to the market's growth, with projections indicating a market value of 97.5 USD Billion by 2035. The ongoing urbanization efforts across Europe suggest a sustained demand for heavy construction equipment.

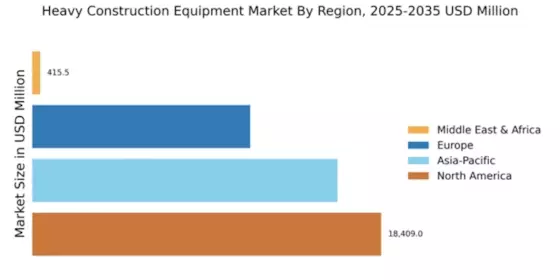

Infrastructure Development Initiatives

The Europe Heavy Construction Equipment Industry is experiencing a notable boost due to extensive infrastructure development initiatives across various European nations. Governments are investing heavily in upgrading transportation networks, including roads, bridges, and railways, to enhance connectivity and stimulate economic growth. For instance, the European Union has allocated substantial funding for infrastructure projects, which is expected to drive demand for heavy construction equipment. This trend is reflected in the projected market value of 46.0 USD Billion in 2024, indicating a robust growth trajectory as these initiatives unfold.

Investment in Renewable Energy Projects

Investment in renewable energy projects is significantly influencing the Europe Heavy Construction Equipment Industry. As European nations strive to meet their climate goals, there is a marked increase in the construction of wind farms, solar power plants, and other renewable energy infrastructures. This trend necessitates the use of heavy construction equipment for site preparation and installation, thereby driving demand. The anticipated growth in this sector aligns with the overall market trajectory, as the industry adapts to support the transition towards sustainable energy solutions.

Technological Advancements in Equipment

Technological advancements are reshaping the Europe Heavy Construction Equipment Industry, as manufacturers increasingly integrate innovative features into their machinery. The adoption of automation, telematics, and fuel-efficient technologies enhances operational efficiency and reduces costs for construction companies. For example, the implementation of smart construction equipment allows for real-time monitoring and predictive maintenance, thereby minimizing downtime. This trend is likely to attract investments and drive market growth, as companies seek to leverage these advancements to improve productivity and competitiveness in the evolving construction landscape.

Sustainability and Environmental Regulations

The Europe Heavy Construction Equipment Industry is witnessing a shift towards sustainability, driven by stringent environmental regulations and a growing emphasis on eco-friendly practices. Governments are implementing policies that encourage the use of low-emission and energy-efficient machinery, prompting manufacturers to innovate and adapt their product offerings. This shift not only aligns with global sustainability goals but also opens new market opportunities for companies that prioritize green technologies. As the industry evolves, the demand for sustainable heavy construction equipment is expected to rise, further propelling market growth.