Expansion of Mobile Commerce

The E-Commerce Independent Software Vendors (ISV) Market is significantly impacted by the expansion of mobile commerce. With the increasing penetration of smartphones and mobile internet, consumers are increasingly turning to mobile devices for their shopping needs. This shift necessitates that ISVs develop mobile-friendly solutions that provide a seamless shopping experience across various devices. Data indicates that mobile commerce is projected to account for a substantial share of total e-commerce sales, highlighting the importance of mobile optimization for businesses. Consequently, ISVs are likely to focus on creating responsive designs and mobile applications that cater to this growing segment, thereby driving growth in the industry.

Advancements in Payment Technologies

The E-Commerce Independent Software Vendors (ISV) Market is significantly influenced by advancements in payment technologies. The proliferation of digital wallets, contactless payments, and cryptocurrency options has transformed the way consumers transact online. As a result, ISVs are compelled to integrate these technologies into their platforms to enhance user experience and security. Data suggests that the adoption of alternative payment methods is on the rise, with a substantial percentage of consumers preferring these options over traditional credit card transactions. This shift presents a lucrative opportunity for ISVs to develop innovative payment solutions that align with evolving consumer preferences, thereby fostering growth in the industry.

Increased Focus on Customer Experience

The E-Commerce Independent Software Vendors (ISV) Market is witnessing an increased focus on enhancing customer experience. Businesses recognize that providing a seamless and personalized shopping experience is crucial for retaining customers and driving sales. As a result, ISVs are developing solutions that leverage data analytics and artificial intelligence to offer personalized recommendations, targeted marketing, and improved customer support. Recent studies indicate that companies prioritizing customer experience are more likely to achieve higher customer satisfaction and loyalty rates. This trend compels ISVs to innovate continuously, ensuring their offerings meet the evolving expectations of consumers, thus propelling growth within the industry.

Regulatory Compliance and Data Privacy

The E-Commerce Independent Software Vendors (ISV) Market is increasingly shaped by regulatory compliance and data privacy concerns. As governments implement stricter regulations regarding data protection and consumer privacy, ISVs must ensure their solutions comply with these legal frameworks. This necessity not only protects businesses from potential legal repercussions but also builds consumer trust. Recent trends indicate that consumers are becoming more aware of their data rights, prompting businesses to prioritize transparency and security in their e-commerce operations. As a result, ISVs are likely to invest in developing compliant solutions that address these concerns, thereby fostering growth and stability within the industry.

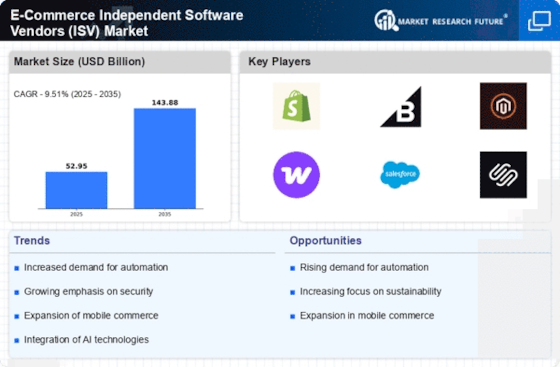

Growing Demand for E-Commerce Solutions

The E-Commerce Independent Software Vendors (ISV) Market is experiencing a notable surge in demand for comprehensive e-commerce solutions. As businesses increasingly shift towards online platforms, the need for robust software that can facilitate seamless transactions, inventory management, and customer engagement becomes paramount. Recent data indicates that e-commerce sales have consistently outpaced traditional retail, with projections suggesting that e-commerce will account for a significant portion of total retail sales in the coming years. This trend underscores the necessity for ISVs to innovate and provide tailored solutions that cater to diverse business needs, thereby driving growth within the industry.