Growing Demand for Customization

The independent software-vendors market experiences a notable surge in demand for customized software solutions. Businesses increasingly seek tailored applications that align with their specific operational needs. This trend is driven by the recognition that off-the-shelf software often fails to meet unique requirements. As a result, independent software vendors are adapting their offerings to provide more personalized solutions. According to recent data, approximately 70% of organizations in the US express a preference for customized software, indicating a substantial market opportunity. This growing demand for customization not only enhances user satisfaction but also fosters long-term relationships between vendors and clients, thereby contributing to the overall growth of the independent software-vendors market.

Emphasis on User Experience Design

User experience (UX) design has become a focal point in the independent software-vendors market. As competition intensifies, businesses recognize that a superior user experience can differentiate their products in a crowded marketplace. Research indicates that 88% of online consumers are less likely to return to a site after a bad experience, underscoring the importance of UX. Independent software vendors are increasingly investing in UX design to enhance usability and customer satisfaction. This emphasis on user-centric design not only improves product adoption rates but also fosters brand loyalty. Consequently, the focus on user experience design is a vital driver of growth within the independent software-vendors market.

Rising Importance of Data Analytics

Data analytics has emerged as a critical component in the independent software-vendors market. Organizations are increasingly leveraging data to drive decision-making and enhance operational efficiency. The demand for software that can analyze and interpret large datasets is growing, with approximately 65% of US businesses indicating a need for advanced analytics capabilities. This trend compels independent software vendors to integrate robust analytics features into their products. By doing so, they not only meet market demands but also position themselves as leaders in a competitive landscape. The rising importance of data analytics thus serves as a significant driver for innovation and growth in the independent software-vendors market.

Increased Investment in Cloud Solutions

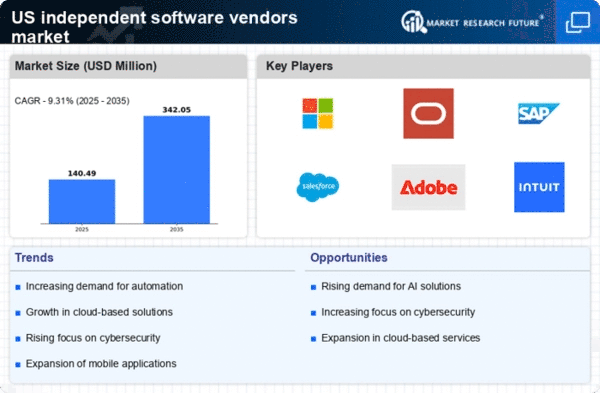

The independent software-vendors market is witnessing a significant shift towards cloud-based solutions. As businesses prioritize flexibility and scalability, the adoption of cloud technologies has become paramount. Recent statistics suggest that over 80% of US companies are now utilizing cloud services, which has created a fertile ground for independent software vendors to innovate and expand their offerings. This transition to the cloud allows vendors to provide more efficient, cost-effective solutions that can be accessed from anywhere. Furthermore, the cloud enables rapid deployment and updates, which are essential in today’s fast-paced business environment. Consequently, the increasing investment in cloud solutions is a key driver of growth within the independent software-vendors market.

Expansion of Mobile Application Development

the independent software-vendors market is expanding in mobile application development. With the proliferation of smartphones and tablets, businesses are increasingly seeking mobile solutions to enhance customer engagement and streamline operations. Recent data indicates that mobile app usage has surged, with over 90% of US consumers utilizing mobile applications regularly. This trend presents a lucrative opportunity for independent software vendors to develop innovative mobile applications tailored to various industries. As organizations recognize the importance of mobile accessibility, the demand for specialized mobile software solutions is likely to continue growing, thereby driving the independent software-vendors market forward.