Market Share

Drone Sensor Market Share Analysis

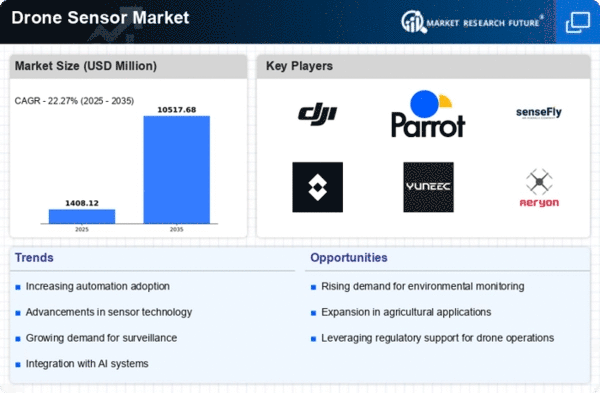

The market proportion positioning strategies within the Drone Sensor Market are critical for organizations aiming to establish a sturdy presence and gain a competitive benefit. One commonplace method employed by agencies is product differentiation. By imparting Drone Sensors with particular capabilities, advanced overall performance, or specialized applications, organizations can carve out an awesome marketplace niche. Pricing techniques are another enormous issue of market proportion positioning. Some corporations choose a value management approach, aiming to offer Drone Sensors at lower costs than their competitors. This strategy appeals to value-aware customers and may assist in capturing a larger market percentage, mainly in charge-sensitive segments. Conversely, a premium pricing method makes a specialty of positioning Drone Sensors as excessive-give-up merchandise, emphasizing superior capabilities, best, and reliability. Companies adopting this method target clients who prioritize performance over fees and are willing to pay a top class for pinnacle-tier merchandise. Market segmentation is an approach that entails targeting particular customer segments with tailored merchandise or advertising procedures. Companies can perceive and cater to the specific wishes of various industries or applications, along with agriculture, infrastructure inspection, or environmental monitoring. Geographical expansion is a not unusual strategy for businesses aiming to increase their market percentage in the Drone Sensor industry. By getting into new markets or increasing their presence in current ones, corporations can tap into rising possibilities and diversify their purchaser base. Understanding nearby variations in regulations, alternatives, and marketplace demands is important for a hit geographical expansion, allowing groups to conform their merchandise and techniques to local conditions. Investments in studies and improvement (R &D) play a pivotal role in market share positioning. Companies that consistently innovate and introduce cutting-edge technologies stay ahead of the competition. By investing in R&D, companies can enhance the capabilities of their Drone Sensors, address emerging market trends, and maintain a leadership position in terms of technological advancements. Building a strong brand image is an integral part of market share positioning in the Drone Sensor market. A reputable brand conveys trust, reliability, and quality to customers. Companies that invest in building and maintaining a positive brand image are likely to attract a loyal customer base. Branding efforts can include effective marketing campaigns, customer engagement initiatives, and a commitment to delivering consistent and high-quality products, all of which contribute to a favorable market position.

Leave a Comment